THE FUNDAMENTALS OF CREATING STRONG RETAILER VENDOR RELATIONSHIPS

This special report by Blacks Retail was prepared in conjunction with the 2022 Society for International Menswear trade fair.

Vendors and retailers have always had a symbiotic relationship — retailers need compelling, new goods to sell, and vendors need the customers those retailers draw in. But the pandemic really highlighted the importance of the strength of these relationships. Vendors who could not show flexibility as retailers grappled with a quickly changing demand curve were deprioritized. Retailers who weren’t quick to pivot to other sales strategies missed out on inventory and opportunities.

Over the past two years, the entire apparel industry faced challenges, and they needed to work closely together to navigate them. Now, with the market stabilizing, strong partners continue to be prioritized over weak ones. That’s why we are predicting a new era of retail relationships, emphasizing communication, transparency, and shared values as brands and merchants tackle market challenges, and welcome new opportunities, together.

Survey Results: What’s Shaping Relationships Right Now

Blacks Retail surveyed both vendors and merchants to determine the current state of their relationships and how recent challenges changed the way in which they do business, with some notable results.

What the brands had to say:

- They have embraced new technologies and new ways to market.

- Although they have mastered virtual technologies, they are excited to get back to the shows and form personal relationships in the physical world, especially with smaller clients.

- Retailer partners who survived the pandemic are stronger than ever: they have mastered omni-channel selling and virtual buying.

- Passion for their brand and a strong sales staff are essential qualities they look for in retail partners.

- Shipping remains a challenge. Some factory orders needed to be placed one year in advance now.

- Their overall outlook is positive: Many brands we talked to are expanding, introducing new lines, and entering new markets.

How To Be a Great Brand Partner

The brands we surveyed said that they value retailers with a passion for their products, and a strong sales staff to back them up. They love it when their products speak to the retailer’s client base.

Vendors like it when merchants buy complete collections, so they can showcase their full concept. In-store events that drive awareness of a brand are always welcome.

Open communication is also an essential element for vendors. Vendors prefer that merchants don’t cancel orders, but if they must, they want retailers to let them know as soon as possible, ideally before the product is made.

And given that some suppliers are requesting orders a year out, cancelling orders within a respectful time frame means that retailers need to figure out their budgets and plans early on. This will reduce cancellations and supply chain confusion.

At the end of the day, good communication means more profit for both retailers and vendors.

Here’s what the retailers had to say:

- The pandemic pushed merchants further into e-commerce and their online business is better than ever.

- Communication with vendors has improved, changing from reactive to proactive.

- Both merchants and vendors are more open to innovative marketing strategies.

- Retailers have been stretched with high demand; vendors that make doing business easy and efficient are prioritized.

- Merchants appreciate when the vendor researches their store and matrix before reaching out.

- Retailers outlook is positive for the second half of 2022; more cautious for 2023.

How to Be a Great Retail Partner

The merchants we surveyed said that they are looking for brands that offer products that they haven’t seen elsewhere, and that fill a void on their floor in terms of the category, style, or price point.

Sticking to a shipping window is another important factor for retailers. This will be especially critical as there’s predicted to be flatter business the second half of 2022. Vendors and retailers should agree on their windows upfront, and if there’s a delay this needs to be communicated as soon as possible, he adds.

Retailers have been accepting late deliveries recently because demand is so high, and they are usually coming into the season with lean inventories.

Retailers are looking for vendors that fill a void on their floor in terms of the category, style, or price point.

But as business becomes more normal, merchants that take on late deliveries will be at greater risk. They will have a shorter window to sell at full price and will likely lose margin.

Margin loss isn’t just a problem for retailers – it affects vendors as well, since they may be paid later than they would if the goods sold early and at full price.

Menswear Market Snapshot

The State of Menswear

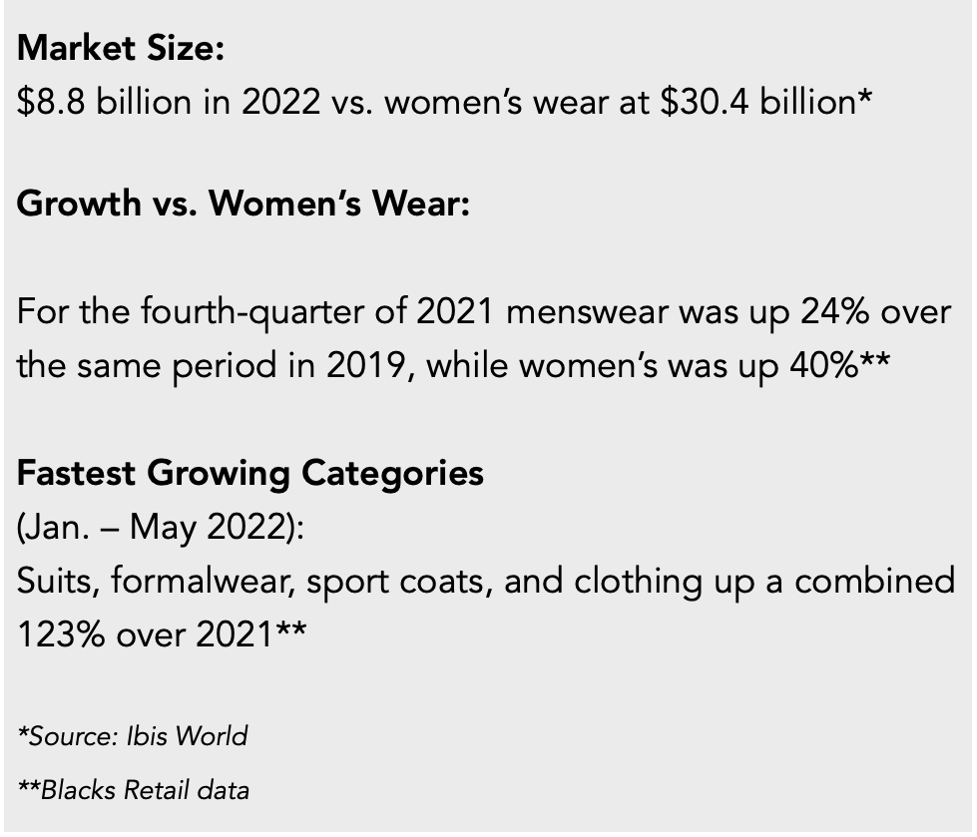

Although the women’s wear market has always been larger than men’s, menswear has seen surprising growth in recent years.

“Today’s men’s market is being powered by a new generation of men that see fashion with a different vision,” says Blacks Retail President Steve Pruitt.

“This generation is engaging Clothing for the first time. The advent of $1.000 made-to-measure suit has been a home run,” he adds.

MR magazine Editor Karen Alberg also sees the growing strength of menswear.

“I really do believe that guys of all ages want to dress better; while ‘better’ means different things to different men, it generally involves buying new clothes,” Alberg says.

Even the mature shopper has come back strong, using fashion to express his individualism, especially at the luxury level, Pruitt remarks.

In fact, the recent rise in menswear is based in a return to historic shopping patterns.

“Men are finally rebuilding their Clothing wardrobes after 2+ years of casual dressing. Since these are pricier items, they are showing up as larger sales gains,” he says. That’s why, among Blacks’ clients, at least, we saw 14 months of straight sales gains in menswear, from early April 2021 to May 2022.

Independent specialty stores have been key to this uptick, according to Alberg.

“Most men would rather shop with merchants they know and trust to guide them in the right direction,” says Alberg.

She adds that choices in department stores and online can be overwhelming. “Quality, fabric, fit, and feel are hard to determine from a photograph, no matter how professional the shot,” Alberg says.

To keep up the momentum in menswear both industry veterans point to fresh products.

“Retailers need to offer more fashion newness in their assortments, taking more risks to create genuine excitement on selling floors,” says Alberg.

Fortunately, new brands and product lines are rushing to meet demand.

“With more men using clothing to express their individual style, menswear has never felt better,” Pruitt adds.

Market Conditions

Lingering supply chain challenges

Although ports are nowhere near as backlogged as they were at the height of the pandemic, supply chain issues still linger, in large part due to severe lockdowns in China. These lockdowns have slowed production of certain materials, and delayed shipping. As of May, roughly 20% of container ships were stuck waiting outside of congested ports to deliver.

Blacks’ Advice: Anticipate longer delivery times than normal. Keep in close contact with vendors to stay abreast of supply chain issues. Retailers may consider spending more of their open-to-buy upfront to ensure they get goods, but they shouldn’t spend more than their plans dictate.

Inflation’s Effect on Demand

Amid a scarcity of goods and incredible demand, inflation continues to tick up, raising consumer prices to levels that are starting to become uncomfortable. When we first emerged from pandemic lockdowns, flush with stimulus money, higher prices were not that much of a burden, but as inflation has increased month by month consumers have become wary of paying too much for certain goods.

Blacks’ Advice: In the short run inflation is good for retail, since it raises prices and merchants make more money. In the longer term it takes a toll on demand, and that’s where we are headed now. Watch your open-to-buy closely—you can’t afford to overbuy at this point.

Need for Newness

Despite economic hesitancy at the lower and mid-tiers of the market, wealthier consumers are still eager to buy new apparel and accessories and reboot their wardrobes from a mostly casual mode to a mix of work and play gear.

Blacks’ Advice: Given the recent dip in demand, newness is more important than ever—that’s the only thing that will get clients back in. Now is a great time to be seeing new products and vendors!

Conclusion

As the last few years have reminded us, disruption fosters change, and hopefully innovation. This is certainly what we witnessed in the retail world, as brands scrambled to adjust to supply chain issues, and merchants found new ways to sell in a dynamic environment. It was a trial by fire, but the players that exist today are stronger than ever and still optimistic about the future of menswear.

Blacks Retail is a leading inventory planning and retail consulting firm, with a specialization in men’s apparel.

Visit Blacks at the SOCIETY trade fair in NYC July 17-18, 2022.