TAILORED CLOTHING REPORT FROM OUR AUGUST 2024 ISSUE: REASONS TO BELIEVE

The entire MR team proudly presents our August 2024 issue. If you haven’t received a hard copy, please page through a digital version at Issuu, and we’ll continue to post individual stories here on MR-mag.com. If you haven’t been getting MR in print, be sure that you are on our mailing list for future issues by completing this form.

No one thought it could last: the post-pandemic boost in tailored clothing sales thanks to a surge in weddings, social events and office re-openings was thought to be a temporary situation. But after three years of sales increases, experts believe the momentum can in fact be sustained, especially at the high end of the market.

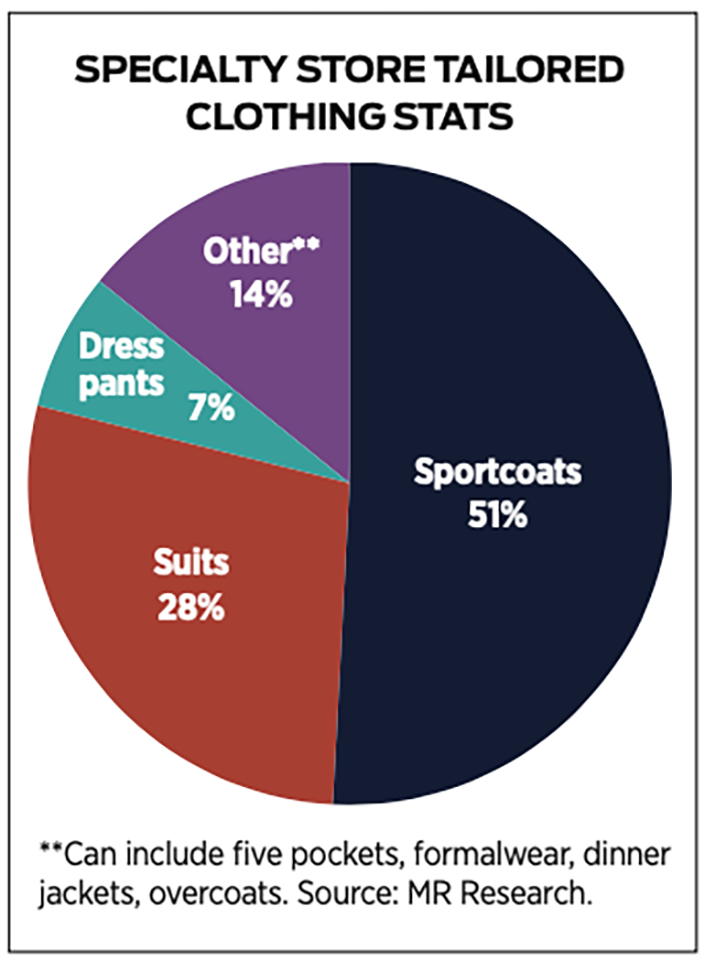

Says Marc Weiss of Management One, a leading provider of inventory and merchandise planning, “The last 12 months have demonstrated that the revenue levels and margins achieved over the past three years are sustainable. Compared to the same period last year, year-to-date tailored clothing sales (made-to-measure and stock) are up slightly: suits up 6 percent and sport coats up 7 percent. Margins took a small but insignificant hit reflecting a slight increase in markdowns and incentives but with a negligible impact on profit.”

According to Weiss, soft coats at higher prices have been exceptionally strong, and buyers are happy to see stable prices. “The outlook should remain positive since department store consolidation and closures allow opportunities for retailers to find new salespeople, new ways to collaborate with vendors, and new ways to distinguish their stores by curating assortments. Based on all this, there’s reason to remain upbeat.”

“Men’s better specialty stores are driving the tailored clothing business as they take share from department stores. I don’t see any reason for this momentum to stop anytime soon. As for margins, clothing is at about 57% over the last 12 months and 59% year-to-date. So we don’t need to focus on increasing margins, but rather on maintaining them. This means keeping inventory levels balanced so we don’t have to increase markdowns. So far, markdowns are at a pretty low 13% year-to-date vs 12% last year. And in most cases, sales are up even with inventory levels down.”

Farrington also confides that price escalation has made it tricky to manage OTB and has affected sales in some cases. “Overall, the biggest challenge has been navigating some big swings in demand and getting inventory to the right levels – occasion suits vs business suits; softer, more casual jackets vs dressier jackets; wool dress pants vs other fabric options, the right level for formalwear, etc.”

Nor is Scott Shapiro from Syd Jerome in Chicago rushing to carry the loose, unconstructed oversized fits shown on runways. “The truth is, most men at a certain age need some structure in their clothing; very few of my customers look good in totally unconstructed garments. When a slightly older guy tries on a well-made suit with a good shoulder and chest, most physical imperfections miraculously disappear.”

Ben Magnuson at MP3 in Minneapolis has maintained demand by promoting a whole new way of dressing: mixing classic tailored pieces with luxury sportswear. “The pairing of luxury sportswear and modern knitwear with classic tailored has been our goal and investment for many seasons now. Customers have embraced it, so we’ll continue to monitor the trends, being especially cautious with ultra-classic styles. The customer demand is very much for newness, comfort and luxury. The greatest challenge we face is being able to move on from brands or categories that used to do well. You can’t go forward if you’re looking backwards. Customers’ tastes continue to advance, and quickly at that. Keeping clients engaged with new ways to build wardrobes that reflect their personal style is best done with new and exciting merchandise! You must be okay with letting sales shift naturally from older styles/categories to the new ones, not letting a feeling of ‘we’re missing sales’ distract the team. It never pays to cling to a down-trending business.”

A final caveat on the super-luxury market from retail advisor Steve Pruitt: “Business is still strong now, but we don’t know what will happen if prices continue to rise. Some merchants believe their customers won’t care, but every time prices jump, they’re selling to fewer customers. I believe it’s time to increase sell-through rates on new vendors, promoting newness by increasing the number of vendors that we rotate. Whereas I normally suggest rotating 10 percent each season, I now suggest 15 percent to keep selling floors fresh and enticing.”

That formalwear pic is from Victor Talbots in Greenvale, N.Y.