INFORMA, NUORDER RELEASE DATA ON ITS DIGITAL TRADE EVENTS

According to new data released by Informa Markets Fashion and NuOrder from its recent digital events, new trends were revealed, suggesting a great need for in-stock programs in the coming months as well as potential larger-scale industry shifts in wholesale buying. While the industry continues to rebuild and recalibrate despite continued market unpredictability, the data-backed analytics signal the resurgence in wholesale activity and globalized commerce as well as the fashion community’s ability to adapt to evolving consumer demand and shifting industry interests.

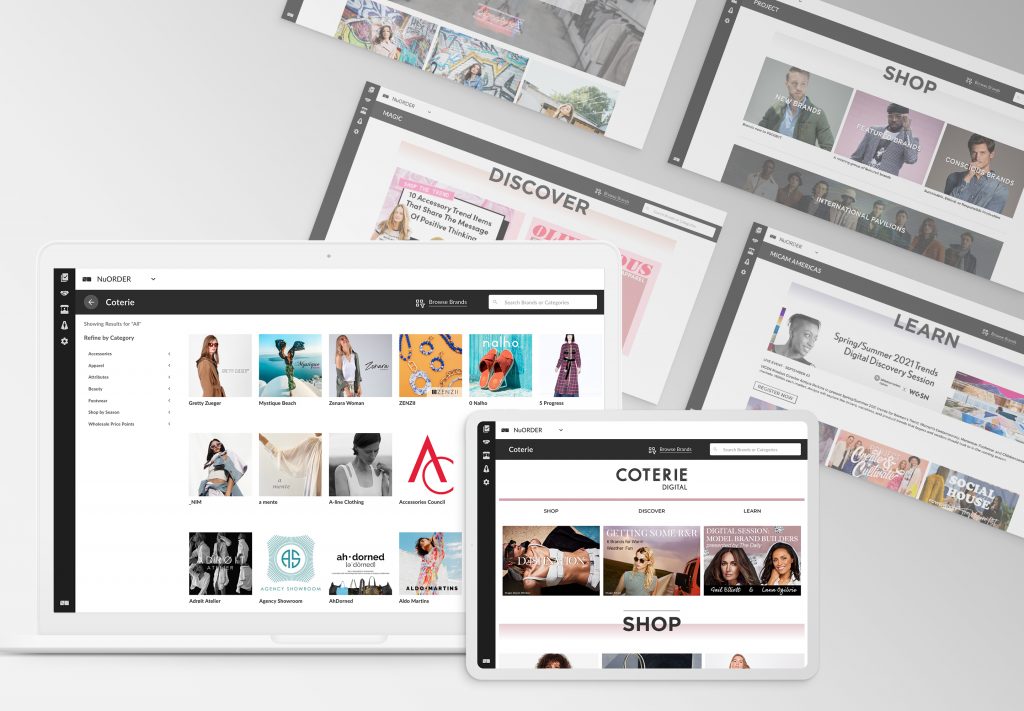

Running from September 1st through November 1st, Informa’s digital events (like Project Digital) featured a wide-ranging offering of product categories and price points with 1,100 brands and a total of 760,000 products ranging across categories of men’s, women’s, and children’s apparel, footwear, and accessories. Over the course of the event, 55,000 connections were made between brands and buyers, and drew an audience of 20,000+ registered qualified buyers from over 97 countries, of which 20 percent of total registration represented new buyers and retailers.

“By embracing a new way to connect and do business through our digital platform, the industry is now able to more quickly and easily come together on a global scale,” said Kelly Helfman, commercial president of Informa Markets Fashion. “With this rebound in globalized commerce, brands and buyers can capitalize on newer business opportunities with even greater scale through a larger variety of vendors and products. Knowing the industry will continue to shift, and with direct connections being an industry cornerstone, we’ll continue in step with the industry needs, offering enhanced opportunities and continually assisting in generating more meaningful engagements.”

Beyond marketplace event data, Informa Market Fashion’s event analytics also revealed trends suggesting in-stock expectation for consumers in the coming months. Blouses were the number one most searched apparel item, followed by dresses as the second most searched apparel item, across all five marketplaces. Alongside this, jewelry was the number one most searched accessory item across all five marketplaces, indicating retailers’ prediction of consumer demand for “ZoomWear”, which references a growing trend in waist-up styling favored over head-to-toe dressing based on global office environment shifts from in-person office settings to work-from-home.

Similarly, activewear was the third most searched apparel item by retailers across all marketplaces, pointing towards the continuation of consumer trends in casual and comfort wear. With an increase in consumer focus on health and wellness following shutdowns and stay at home orders both domestically and worldwide, these trends – while not surprising – indicate this pandemic-stimulated ‘micro-trend’ will continue forward in the coming months, with potential longer and larger reaching staying power.

Additionally, data-backed buyer behaviors also emerged, indicating a potential market refocus and possible future-facing larger-scale industry shifts in wholesale buying. Sustainability was the second most searched brand attribute (17 percent) by retailers across all marketplaces. While this trend in consumer interest has gained more traction in previous years, the pandemic has not only accelerated the critique of consumerism through a movement towards increased demand of higher quality, longer-lasting products but also the introspection and reflection in doing more with less and a more mindful approach in product production.

Of further significance, dropship was the most searched brand attribute across all marketplaces (22.5 percent) by retailers. With the unpredictable consumer demands in 2020 and resulting reactionary markets, this data indicates retailers and brands are increasingly looking for additional ways to mitigate risk. Retailers are doing this by carefully shifting toward a more demand-focused model, thereby boosting flexibility to capitalize on market behavior and opportunities, while brands are responding to this need by reducing complexities and increasing opportunities for full-price sell-throughs.

“While the demand for digital tools and more robust technology was accelerated by COVID-19, the industry’s digital adoption also allows us to uncover extremely useful industry trends and behaviors,” added Heath Wells, co-founder and co-CEO of NuOrder. “Through this data, we’re able to see retailers’ and brands’ immediate response to changing market needs, which helps inform the fashion industry. Continuing forward and as we synthesize more data with the return of Informa Markets Fashion’s digital events in the upcoming fashion buying cycles, these data models will continually be enriched – offering the fashion industry actionable market insights.