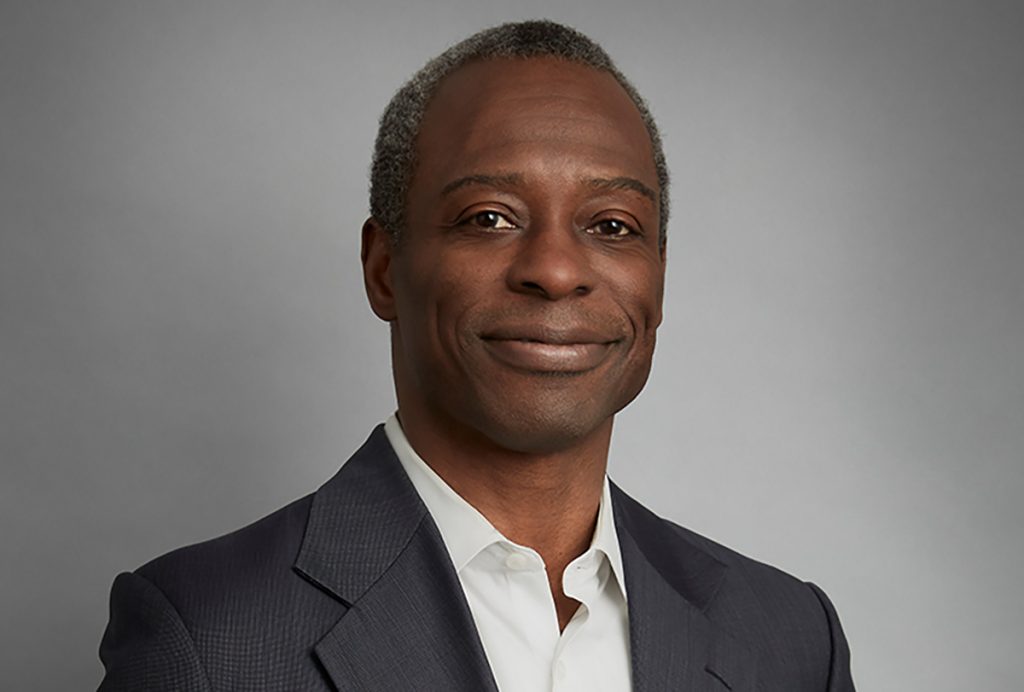

JIDE ZEITLIN RESIGNS AFTER BRIEF STINT AS TAPESTRY CEO

Tapestry, Inc. chairman CEO Jide Zeitlin has resigned, the parent to Coach, Kate Spade and Stuart Weitzman announced on Tuesday.

Zeitlin said his resignation was “for personal reasons.” Appointed to the chief post on an interim basis in fall 2019, Zeitlin said in March that he planned to stay in the roles of chairman and CEO for the next three years. Over the past 14 years, he served in numerous roles at Tapestry and predecessor Coach Inc., first as a director before being named chairman in November 2014 and CEO last fall.

“It has been a privilege to lead Tapestry with its powerful brands and outstanding people,” said Zeitlin. “I have incredible belief in the company’s growth potential as each brand sharpens its focus on meeting the broad and diverse needs of their consumers.”

“Jide has made meaningful contributions to Tapestry over the past 14 years, first as a director, and then as chairman, and most recently as CEO,” added Susan Kropf, the company’s chair of the board. “During his tenure as CEO, he played a key role in driving the development of Tapestry’s strategic growth agenda. Importantly, he led with purpose during these unprecedented times. We thank him for all he has done for the Company and remain committed to continuing this important work.”

Coinciding with Zeitlin’s departure, the company has announced a series of interim appointments. CFO Joanne Crevoiserat has been named interim Tapestry CEO. President, chief administrative officer, and company secretary Todd Kahn will serve as interim CEO and brand president of Coach. Global head of investor relations and corporate communications Andrea Shaw Resnick has been appointed interim CFO, and lead independent director Susan Kropf has been made chair of the board of directors. The company will commence a search for a permanent CEO, looking at internal and external candidates.

The company expects to report fiscal fourth quarter results on Thursday, August 13th. These results, though pressured by the COVID-19 pandemic, exceeded internal expectations from a top and bottom-line perspective. Importantly, gross margin expanded on a year-over-year basis, reflecting lower promotional activity, while inventory declined from prior year. In addition, the company ended the year with a significant cash balance of approximately $1.4 billion.