PVH SEES REVENUE INCREASE IN THIRD QUARTER

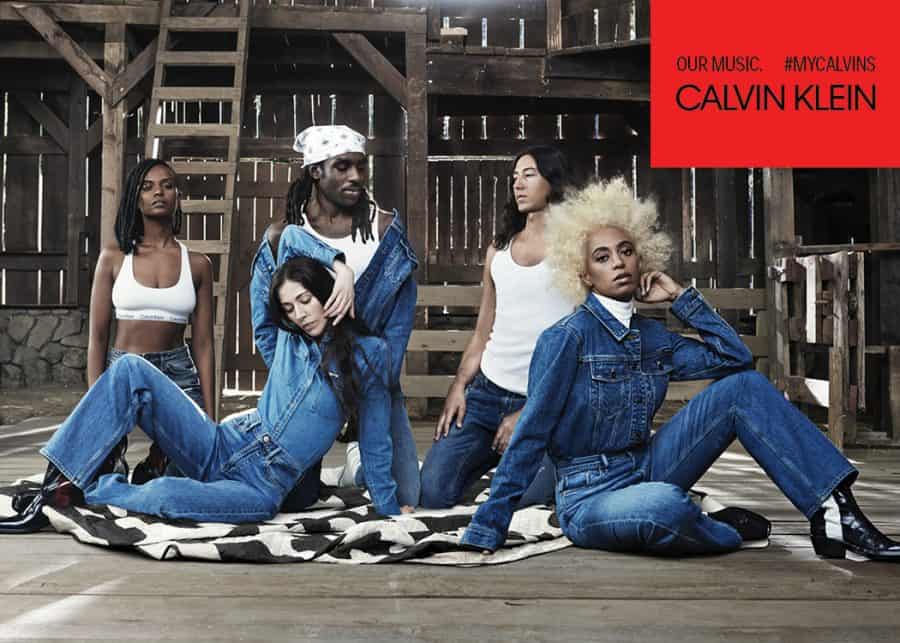

Revenue in the company’s Calvin Klein business for the quarter increased 6 percent to $943 million, which includes an approximately $20 million reduction resulting from the November 2016 deconsolidation of the company’s Calvin Klein business in Mexico. Growth was very strong in the international sector, while Calvin Klein North America revenue decreased 5 percent to $476 million primarily as a result of the Mexico deconsolidation and a 1 percent decline in North America comparable store sales.

Revenue in the Tommy Hilfiger business for the quarter increased 10 percent to $1 billion compared to the prior year period. Tommy Hilfiger International revenue increased 1 percent to $609 million while Tommy Hilfiger North America revenue increased 2 percent to $410 million.

Revenue in the Heritage Brands business for the quarter decreased 7 percent to $396 million, which was principally attributable to a planned shift in the timing of wholesale shipments from the third quarter into the second quarter as compared to the prior year periods. Comparable store sales increased 2 percent.

For the full year 2017, revenue guidance has been raised to a 7 percent increase from previous guidance of 6 percent increase. In addition, guidance for earnings per share on a Non-GAAP basis were raised to $7.78 to $7.80 from $7.60 to $7.70.

“We have raised our full year earnings outlook based on our third quarter performance, the improvement in foreign currency and our belief that the strength of our brands will continue to drive revenue and profitability increases throughout the fourth quarter. Our more favorable outlook takes into account a strong start to the holiday season and an additional $20 million increase in our fourth quarter marketing expenditures to capitalize on the continued momentum we are seeing across our businesses,” added Chirico.

“We believe that the incredible brand power behind Calvin Klein and Tommy Hilfiger will drive continued market share gains and allow us to capitalize on the brands’ significant growth opportunities going forward,” he continued. “We believe that we are well positioned to execute our strategic priorities through the efforts of the talented associates at PVH, enabling us to deliver long-term stockholder value.”