TAILORED CLOTHING WEEK: SUIT FUTURES – RETAILERS TALK TAILORED

Against all odds, 2021 turned out to be a surprisingly good year for tailored clothing. Despite the unyielding pandemic, record supply chain disruption and higher costs for both materials and shipping, most retailers reported increased consumer demand for the past three quarters, resulting in fewer price promotions, more productive inventory and higher AURs.

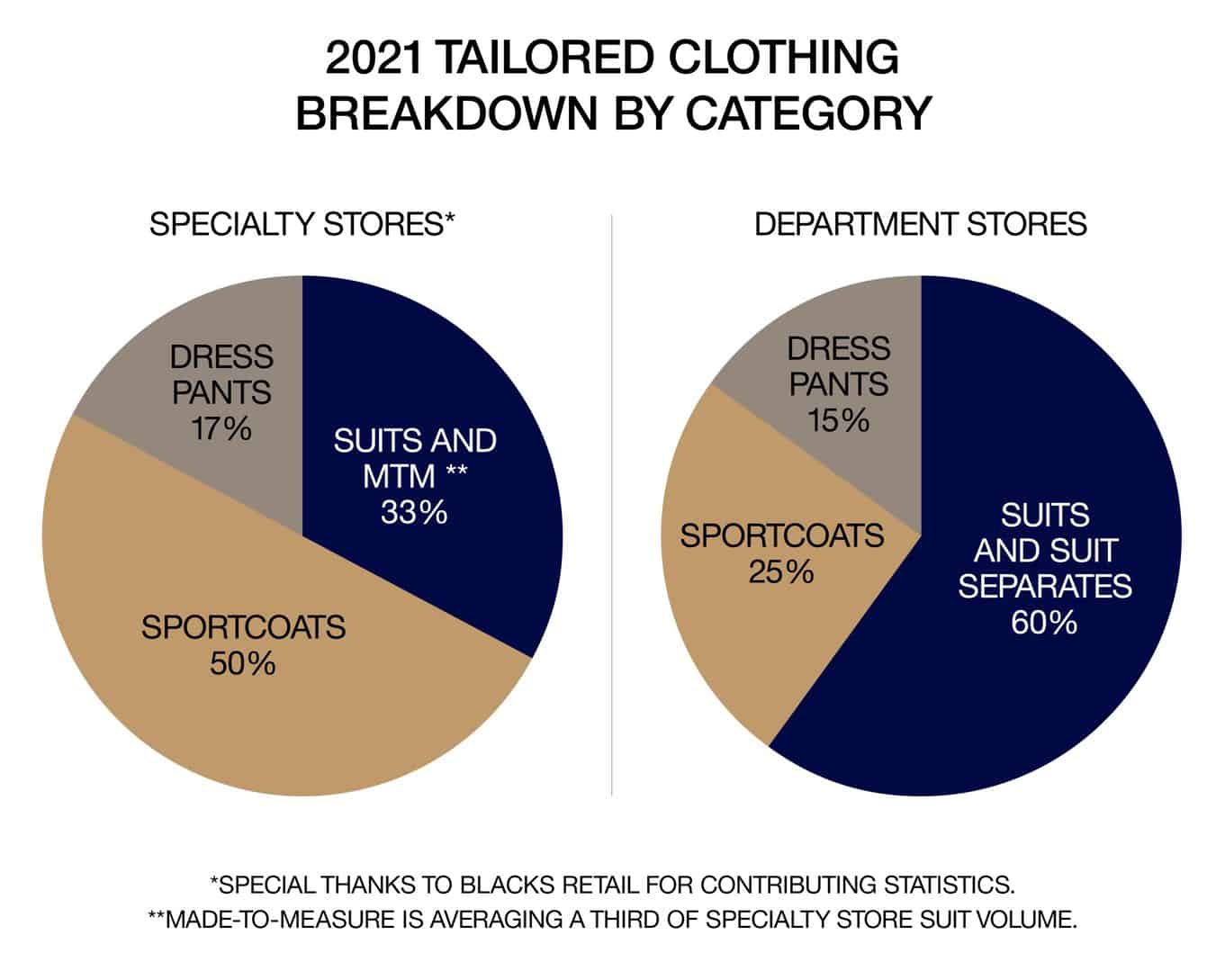

As retail analyst Steve Pruitt from Blacks Retail puts it, “My clients were all complaining: they couldn’t get inventory, they couldn’t find good sellers, their costs were up… Yet somehow they did more business than ever. Most are in better financial shape today than they were pre-pandemic…”

What’s more, thanks to weddings and events already booked into 2023, suit business is expected to continue strong. Most merchants have planned first quarter increases, with smaller gains for the rest of the year. Many also project a fall ‘22 pendulum swing to luxury sportswear and hybrid tailored items like softcoats, vests, shirtjacs and chore coats.

To what extent consumers will jump on this new category, especially at luxury pricepoints, remains to be seen. The conundrum: while retailers aspire to be flexible, letting customers dictate what’s next, they also need to place orders early to ensure timely delivery. (Whoever said this business is easy?)

Here, inspiring thoughts from a variety of smart merchants.

Dan Farrington, Mitchells Stores: “The key to getting Tailored fully recovered rests with sportcoats.”

The tailored clothing business is alive and getting well, according to Dan Farrington at Mitchells. “We’re not back to peak levels yet, but we’re getting closer and see a path to full recovery. A lot will hinge on when people really return to a full schedule of office time, in-person business meetings, and travel. Omicron is, hopefully, the last hurdle before we see a wave of dress-up sales for business needs. In the meantime, we’re offsetting fewer sales of everyday business suits with occasion suits, tuxedos, and dinner jackets. We’re getting past some frustrating supply challenges for the most part. We expect very strong business for occasions including weddings for the near future.

“But the key to getting Tailored fully recovered rests with sportcoats. As soon as men have to ditch the hoodies, sweats, or zip sweaters for a more polished outfit, the sportcoat becomes the main element. But we’ll need to grow well past peak sportcoat levels to fully recover.”

John Tighe, Tailored Brands: “We’re very proud to have USA production.”

“Our business has bounced back strong since the vaccines appeared,” says the Chief Customer Officer at Tailored Brands. “Men’s Wearhouse has always been about helping guys prepare for important life moments. And our wedding business (both sales and rentals) is now on fire, not just suits but also white dress shirts, accessories and shoes.”

Tighe cites some encouraging national statistics: projections of 2.6 million weddings in 2023 vs. 2.1 million. “It’s hard to get venues: people are needing to get creative, booking events on Thursdays and Sundays,” he observes.

Based on strong event business, tailored clothing at Men’s Wearhouse is driven by basic black, grey and navy suits, a mix of national brands (Calvin, Lauren) and directly sourced store brands (Joseph Abboud, Kenneth Cole Awearness and Aweartech). Suit prices range from $200 to $599 in store, with Joseph Abboud (half-canvas, Italian fabrics, made in New Bedford Mass) ranging from $899-$1300 (custom). “We’re very proud to have USA production,” says Tighe of his esteemed New Bedford facility. “We also do some of our custom in Mexico.”

Tighe adds that his terrific buying and store teams deserve accolades for persevering through some tough times of late, including both pandemic and bankruptcy issues. (Editor’s note: Tailored Brands emerged from bankruptcy this past fall). Admitting that with a strong focus on suits, his sportcoat business is probably underdeveloped, Tighe looks forward to defining a whole new way to dressing as guys start returning to offices in beautiful tailored sportswear and layering pieces.

Murry Penner, M. Penner, Houston: “What I used to see as a movement to sportswear, I now consider a redefinition of tailored.”

“Business these days is tough to plan,” asserts Murry Penner from M. Penner in Houston. “I really dislike having to buy earlier and earlier. The acceleration of markets is a challenge.”

He goes on to note that in general, he’s optimistic about tailored clothing business. “I believe people will be buying new clothes for a while, and not just for weddings. They want to dress up for parties, for events, for just going out to dinner. They don’t want to wear the clothes they wore throughout the pandemic; they want something new!”

A bright spot for Penner: made to measure is now 25 percent of his total men’s business, an important handle and competitive advantage going forward.

“What I’ve seen in the market this past week bodes well for my optimism. What I used to see as a movement to sportswear, I now consider more a redefinition of tailored.”

Tom Malvino, Louis Thomas, California “Carrying in-stock suit separates saves on alterations and offers quick turnaround.”

Tom Malvino has been celebrating his stores’ 75th anniversary and the rebound in suit business. “We starting out as an army surplus store in 1946; we’re now an upper moderate suit store with suits retailing from $600 to $1000. We can’t make up that volume selling joggers…”

According to Malvino, clothing business picked up dramatically in recent months. “Guys are ready to go back to work but after years of wearing the same two sportcoats, they’re either bored with them or they’ve gained 30 pounds and the coats no longer fit. Grooms and fathers of the bride are definitely looking for something new and special; if a guy is going to the Commodore’s Ball, he wants a tuxedo with all the trimmings.”

He’s also selling lots of separates. “We merchandise separates as suits but explain to customers that they can get the jacket and pant in different sizes. If we don’t have the size in stock, we get it from a replenishment program since many brands (Jack Victor, Betenly) now stock upscale separates. This saves on alterations and offers quick turnaround so everyone is happy.”

Confirming that his made-to-measure business is also healthy, Malvino adds that not all customers can wait four to five weeks. “By the time they decide they need a new suit, their event is just days away…”

Howard Vogt, Rodes, Louisville KY: “Buying closer to season is harder on the vendors but it’s what we need to do.”

Howard Vogt from Rodes offers two predictions about future business: that he will do less tailored clothing business than he used to, and that the major brands will do more direct-to-consumer.

What’s driving business now at Rodes is five-pocket pants and cool sportswear available in season. “Buying closer to season is harder on the vendors but it’s what we need to do. Luxury collections featuring hybrid tailored sportswear from brands like Corneliani will continue to grow. Staffing is still and will remain a big problem. In the end, we’ll say that the pandemic completely changed our industry and how we do business.”

Steve Pruitt, Blacks Retail: “Worry less about what will happen and more about what you’ve learned…”

According to retail advisor Steve Pruitt, his preach to his retail clients has hardly changed with the pandemic. “Control your inventory, control your cash flow, and don’t get ahead of yourself by over-buying.”

While Pruitt strongly believes that vendors should supply a constant flow of innovative product, he understands why many haven’t. “It’s been difficult for them with travel restrictions and more limited budgets. Unfortunately, this has resulted in less R&D. Designers should certainly be in Europe and Japan but few are going. It’s as if the creativity has been drained out of the business.”

On the plus side, the pandemic has assured retailers that less inventory is the way to go. “Retailers had been carrying way too much inventory that they had to sell-off end season. This year, they took fewer, shallower markdowns in January, not December, a much healthier strategy that they should continue.”

While Pruitt believes that recent increased consumer demand is unlikely to continue indefinitely, retailers who manage their inventory will come out just fine. ‘’Retailers should worry less about what will happen and more about what they’ve learned.”

Jay Fillings, Fillings, Lancaster, Pa: “We need more variety, more fashion.”

At Fillings, recent suit business has been wedding/event-driven. “Our suit business for second and third quarters was 119 percent over 2019,” Jay Fillings reports with obvious pride. “We had the best October in our history.”

Citing a broad resource structure in tailored clothing with retails from $695-$2000, key brands include Jack Victor, Canali, Samuelsohn, Baroni, Empire, and Trinity. “MTM was twice the volume of off-the-rack but we’re now doing more suit separates since most guys need at once delivery. Jack Victor does a great job with separates: black, medium blue and navy, with delivery in 17-20 days.”

What’s needed going into 2022? “Vendors need to air in goods, and not depend on containers. There are massive back orders on all products. It’s a congested mess trying to figure it out: it takes 20 percent more time.

“We also need more variety, more fashion. Our plan for fall ’22 is to aggressively feature fashion and fill in on basics as needed.”

Fred Derring, DLS Buying Office: “Wider lapels and slightly looser fits are important developments.”

“SOFT is the buzzword for fall ‘22 tailored clothing,” says Fred Derring of DLS, known for its expertise in covering the market with partners Lee Leonard and Virginia Sandquist. “Both sportcoats and suitings are available without pads or linings, very relaxed, lightweight, comfortable and perfect for travel. Olives, browns and lavender give a fresh feel to fall collections. Wider lapels and slightly looser fits are important developments.”

Derring believes the most exciting development is traditional clothing companies embracing elevated sportswear. “Even custom companies have added sportswear to their offerings: knit jeans, shirt jackets, footwear and accessories. This will help put more ‘special’ back in specialty stores!”

Steve Bratteli, Bratteli Family Stores: “In many stores, the business model is healthier.”

Steve Bratteli is happy to report that 2021 sales were in the plus column. “Traffic has been way up since April; sales are strong in almost every category. Our big increases have been in formalwear, sportswear, sweaters, casual pants, dress shoes, and sneakers. We decided about a year ago to keep our inventories full. We didn’t have to chase goods: in spite of certain vendors cutting back on production, we had very limited shortages.”

Bratteli confirms what many specialty merchants are finding: less inventory means higher AURs and higher margins. “As a result of cutting staff and other expenses, many retailers now have lower costs, meaning the business model is healthier.”

Confiding that his tailored clothing is down from 60 to 40 percent of total store volume, he nonetheless hopes he can once again count on in-stock replenishment programs. That said, he maintains that suiting in general has become a bit too basic, with fashion available mostly in sportscoats.

“Although prices are definitely up, I’m estimating by six to eight percent or higher, I don’t project a big pushback. I’m feeling confident about the economy, the stock market, and companies getting back to a more normal cycle. I believe we’re getting used to the new variant; we’re learning to live with it.”

Craig DeLongy, John Craig Stores, Naples and Winter Park Fla: “I don’t think our customers are ready to loosen up…”

Craig DeLongy proudly reports his best business ever, with the biggest increases coming from tailored clothing, comprising 23% of his total volume and driven by sportcoats. A full one third of this clothing volume is now in made-to-measure, and MTM now extends to sportswear, outerwear and shoes.

DeLongy attributes recent strong business to trading up, to bringing in luxury collections like Isaia and Kiton and building on better brands including Canali, Baldassari, Gimos and Castangia. “I’m not a believer in looser fit clothing, at least not yet,” he affirms. “Our better shirt collections (Eton, Emanuel Berg, Stenstroms) are trimmer than ever; I don’t think our customers are ready to loosen up…”

He also credits regular team meetings and sales competitions for boosting energy and morale among his talented sellers.

Ed Boas, Lanes Miami: “It’s wonderful to see 40-year-olds buying luxury Italian brands!”

Until third quarter 2021, Ed Boas had been seeing a major shift in how his customers were dressing. “They didn’t wear suits unless they had to; their wardrobe was mostly, denim, tees, knits, softcoats and overshirts.” But like it did for many retailers, a surge in 4th quarter weddings and events meant a resurgence of sales in suits, blazers and dress pants, still slim-fit.”

Boas takes little credit personally for healthy business. “We lost a local Bloomingdales and a Nordstrom. Plus we’ve gained an influx of affluent customers in their late 30s, 40s and 50s from Silicon Valley and the New York area. They’re accustomed to buying better product and, since their cost of living is cheaper here than where they came from, they’re spending on clothes. It’s wonderful to see 40-year-olds buying luxury Italian brands!”

David Perlis, Perlis, NOLA and Baton Rouge: “We have to place orders 8-12 weeks out to get basics, so we’re scrambling.”

At Perlis, tailored clothing business has been healthy since June. “Of course, we missed some business on hard-to-get inventory but fortunately, customers seemed willing to buy whatever we had,” says David Perlis, noting that MTM is 15 percent of clothing sales and that tuxedo rental business has also been healthy.”

Key clothing brands here include Jack Victor, Samuelsohn, Maxman and Peerless (also Canali in Baton Rouge). Although Perlis is optimistic that clothing increases will continue (wedding venues are booked solid, Fridays and Saturdays, through 2022), he says he’ll plan cautiously for the second half of ‘22 when up against strong numbers.

“The biggest problem remains getting merchandise: we have to place orders 8-12 weeks out to get basics so we’re scrambling. We need a good/better/best strategy but it doesn’t really matter where our $895 suit comes from, as long as there’s good value in the garment. We’ve had success with both TailoRed and Hart Schaffner Marx.”

Other excitement at Perlis: a remodel of the NOLA store. “We do it every 20 years,” says David. “It’s time.”

Rick and Jim Penn, Puritan Cape Cod: “Our online presence surely helps drive store traffic.”

According to Jim and Rick Penn, the biggest lesson of the pandemic has been learning to operate in times of uncertainty. “The delta in sales plans from the lows of 2020 and the better than expected results of 2021 is something we’ve had to adjust to. The words pivot and fluid are now part of our everyday vocabulary. And we feel very fortunate to have received such great support from our key vendors.”

They note that the return of dress clothing business has reinvigorated suits, dress shirts, pants, and footwear. Better sportswear is also being well received by their customers.

“Our main goal for this year is to reinvest in the business. We’re planning on renovations in two of our stores and will continue to invest in our online business, which was 3.5 percent of our volume in 2021 and is planned at 5 percent for this year. It’s still a small portion but continues to grow and surely helps drive store traffic.

Marc Weiss, Management One: “The pandemic has opened minds to change.”

“The pandemic has opened minds to change. Smart retailers are starting to think of themselves as a brand, rather than a store. For 30 years, I’ve believed that success depends on having good people and good product. I’ve now added good marketing to the formula. Creating great content, storytelling, is so critical today: if done correctly, it will sustain the business, even in tough times. Other areas of opportunity for retailers: collaborations, private label and catering to younger shoppers.

“That said, I think that despite inflation, the consumer appetite for shopping will continue through fall. Retailers should double down on key vendors and focus where the strength is. They’ve learned from the pandemic that they don’t need to take excessive markdowns but do need to offer fresh product on an ongoing basis.”