CAN RETAILERS SURVIVE THE “SEISMIC SHIFT”?

The photo of a man looking at an approaching tidal wave is the perfect metaphor for the current state of the retail industry, said noted analyst and author Robin Lewis, speaking to a packed house at the Retail Marketing Society luncheon at Arno on Tuesday, January 23. “Those retailers who do not navigate the seismic shift now happening in retail will be wiped out,” said Lewis, referring in part to his recent book “Retail’s Seismic Shift” (co-authored by Michael Dart).

As Lewis outlined, numerous factors have emerged in recent years that have drastically changed the retail landscape. To begin, Lewis noted that the “supply and demand imbalance” is perhaps greater than ever. Even with all the store closings of the past few years (especially in the apparel industry), Lewis noted that “we remain overstored and overstuffed. There is now 46 square feet of retail space for every man, woman, and child in America.” While brick-and-mortar spaces can continue to thrive, Lewis also reminded the audience that there is significant growth in e-commerce, with literally hundreds of websites arriving on the scene each week.

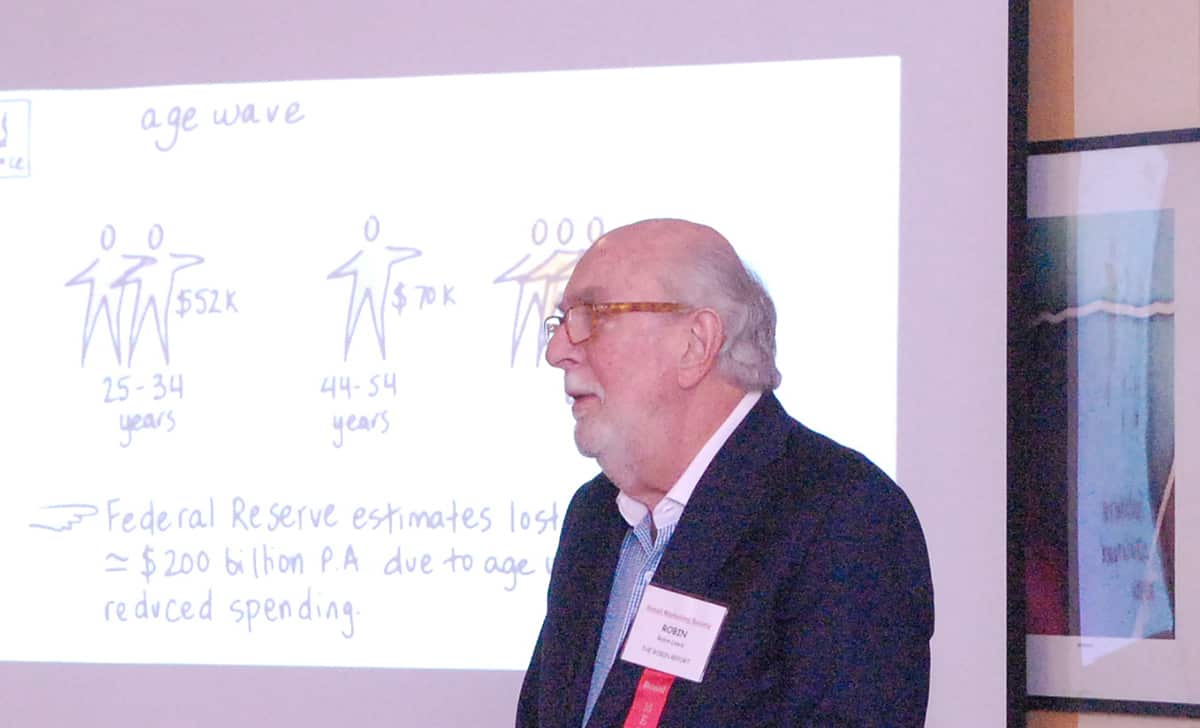

Among the reasons Lewis believes that demand will never again equal supply is that as baby boomers begin to “age out of the workplace,” they will spend less on goods, while their successors – members of the Gen Z and Millennial generations – are significantly more likely to spend their money on experiences rather than products. In addition, even when buying product, those generations are far less likely to trust big companies (both retailers and vendors) and are likely to give their business to more mom-and-pop stores or even begin “peer-to-peer commerce.” Moreover, these age groups are predisposed to value peer recommendations, social media influencers, and brand ambassadors over traditional advertising.

In addition, he said, all retailers are now faced with how to fight the predominant philosophy of discounting. “Price deflation has become the basis of competition in all areas of retail,” noted Lewis. “However, to attract the younger consumer, retailers need to stress both value and values; they are more concerned with how and where a product is created, its presentation, the opportunity for personalization, the causes they support, etc. In fact, they are willing to pay full price for a product they really value.”

Lewis also added that the consumer market is more fragmented than ever, with retailers and brands having to attract hundreds of separate niche markets based on factors such as age, sexuality, wealth. “More than ever, people live and shop in their own ‘neighborhoods,” he notes. “There has never been a time with a lower propensity for someone to live next to someone different than themselves.”

Perhaps, most importantly, brick-and-mortar retailers must learn to embrace the current technology, ranging from the use of virtual fashion mirrors and chatbots to detailed data collection on the shopping habits of each and every consumer, allowing the consumer to have a more personal experience not only when they walk into the store but before and after they leave it as well. “Retailers must treat every consumer as a constant Point of Sale, and work to flow their products as quickly and efficiently into each consumer’s hands.”

That said, Lewis admitted that one reason many retailers, especially long-established stores, have been struggling with adapting to technology is two-fold. “They don’t really know how the clicks/bricks balance will eventually balance out, and, more importantly, they don’t know if there will be better technology coming out next week.”

Still, Lewis repeatedly stressed that we are facing a “new world” of retailing where only those companies that can adapt and reposition themselves to appeal to younger consumers will survive.