GETTING LOUD ABOUT DRESS UP!

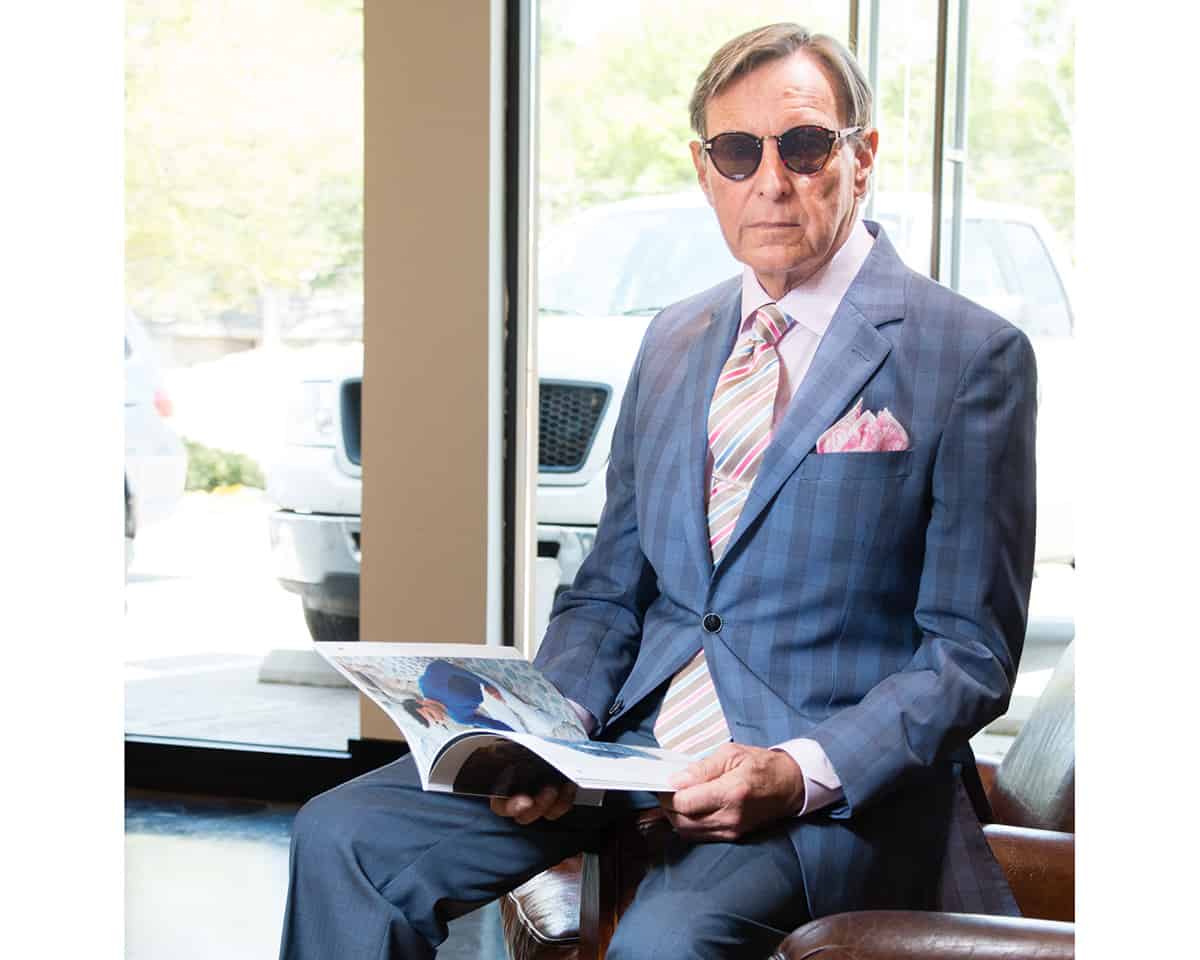

It’s MR’s Tailored Clothing Week, powered by Peerless: Join us all week as retailers share how they’re faring in 2022, and what changes they’re planning for 2023. We’ll also show the latest spring 2023 fashion trends in tailored clothing, present in-depth interviews with Macy’s Omni Buyer, Men’s Tailored Clothing Irene Lazaroff and JCPenney’s SVP/GMM Chris Phillips, and share insights from key brands about how their business is evolving. A Man on the Street feature reflects the attitudes of true clothing aficionados who wear suits and sportcoats, even in 90-degree weather!

The good news: Recent tailored clothing business has been at record highs this spring/summer, driven by postponed weddings, customer weight changes, and pent-up demand. The bad: few retailers believe these increases can be sustained; while planning for a healthy fall ‘22 and spring ’23, they’re less confident after that. Here, we talk to some smart independent merchants about the recent surge in sales, the future of suits, and the changes they’re making going forward. Among the key take-aways:

- Luxury customers are “going out with a vengeance!” Parties, restaurants, events have inspired new clothing purchases.

- Supply chain issues remain problematic, especially at the mill level. Certain vendor stock programs have been depleted.

- The prevalent slim-suit model (shorter jacket, shorter pants) has been around for a decade or two. Forward-thinking retailers believe it’s time for a model change; more conservative merchants say, “If it aint broke, don’t fix it!”

- Made-to-measure and customization are growing trends in both moderate and luxury stores.

- Patterned sportcoats are gaining traction, mostly less structured, as are knits.

- Key retailer problems remain finding motivated sellers and talented tailors.

- Respondents expressed mixed opinions on the value of online selling.

- Average unit retails are up; in-store price promotions are down.

- Smart retailers are doing more with less, selling what they have, not chasing every sale.

- There’s no shortage of suits in America: specialty stores must stay special to survive.

Johnell Garmany, Garmany, Red Bank, NewJersey

We’re up 55% for the year-to-date in clothing, and planning for a 5 to 10% decrease in 2023

The recent surge is because people are finally starting to go out and are realizing that they don’t fit into their pre-Covid suits and sportcoats. Also, the sportcoat has become the man’s version of a woman’s handbag. It’s an accessory: men are literally wearing their personalities on their sleeves.

We’ve made several changes in our business post-pandemic, including reduction of store hours. We’re also perpetually looking for more team members. We just can’t find enough. Our marketing strategy has also changed a bit. We’re focusing on communicating our team member’s personalities.

What keeps me up at night? Oh I don’t know… How about gas prices, inflation, high interest rates, etc? Other than that, everything is awesome!

Supply chain issues have also been a problem. Basic white shirts, navy suits and tuxedos have been difficult to replenish lately. A lot of vendor stock programs have been depleted.

We haven’t had a ton of events lately, but for the most part, the ones we’ve had have been successful. People need a reason to get out of their houses and into our store. Even though the pandemic has somewhat subsided, many people are still avoiding crowded spaces. Fortunately, our store is large so we can provide a safe experience.

Developing an online business was supposed to be our focus for 2020. I forget what happened, but something got us off-track, lol. In all seriousness, we hope to have an online business by the end of 2023. We’ve benefited greatly from our clients wanting an in-person experience, but clearly online has been, and will be, the future.

My crystal ball: I think we might struggle a bit over the next couple years, but I see it eventually coming back. Our fashion focus is suits that can be worn as separates. Whether it’s a double-breasted patch pocket model to wear with a great pair of jeans or the matching pants to wear with a T-shirt and sneakers.

Murry Penner, M.Penner, Houston, Texas

Our tailored clothing business has been exceptional, up 50-60 percent year-to-date. In addition to weddings and events, the sportcoat has become the new suit as people are getting out again, to parties and restaurants. Business had been tough but with pent-up demand and vendors stepping up to the plate with some fresh ideas and new models, it’s back. Of course, the model changes are subtle but we’re acknowledging them: pants not so short, lapels slightly wider, pleats that are clean and flattering, overshirts and tailored chore jackets. Color rules for spring ’23: in muted patterns and new solids like sage green and fresh pastels.

I might be alone here but I’m not so sure the economy will fall apart. Our customers have money; they’re out enjoying life; there are more social events than ever. People with money are spending money as evidenced by increased sales of fine jewelry and fancy cars during the pandemic. They didn’t buy clothing because they had nowhere to go, but now they do. So while we might not sustain 50 percent increases, business will remain strong as long as we buy smart, show new, and do more with less.

How to do more with less? I’ve learned the hard way: sell what you have; you don’t have to chase every sale. If the customer comes in for a certain PT pant in a size 34 and you’re out of it, sell him the 34 Zegna. Don’t assume he doesn’t want the Zegna, at least get him to try it on.

We’re also investing in some store renovation to freshen things up a bit, which is always energizing. When you’re positive and projecting success, customers will support you. Our customers truly appreciate what we’ve done for them over the years, and we truly enjoy doing it. Why else would we be in this business?

Fred Derring, DLS Apparel Group

Our member stores have enjoyed extraordinary clothing sales for about 12-months. Realistically, we don’t believe these increases can be sustained. Caution is the key word. The biggest increases have been in three important areas: Custom, Separates, and Softcoats. Here, we think robust sales will continue. Stores are also selling shirt jackets, chore jackets and safari jackets. These items create a dressier vibe when worn with a tie or a trendier look with a bandana/neckerchief.

On another note, DLS was amazed to see the amount of tech fabrics in the better (Italian) clothing market, adding a younger/cooler bent to suits and jackets that many stores are looking for these days.

Scott Moorman, Moorman Clothiers, Ames and Mason City Iowa

Our tailored clothing business is up 25 percent over last year and last year was the best in our 29-year history. I’d planned business down 20 percent, but we’ve managed to ride the wave. Sales are up considerably and so are margins.

I’m not sure we need a model change: most guys seem happy with a slim or tailored fit. Maybe we’ll add a few more DBs or perhaps a three-button slim suit makes sense, but I can’t envision a new model that will take over. One example: a gentleman came in the other day to buy his first suit in 20 years. He tried on a tailored fit and his wife couldn’t get over how great he looked compared to the big, baggy styles he has in his closet.

We do a good business with HSM, Jack Victor and Tiglio (for margin: suits at $135 cost we can retail for $495). Supply chain backups have not been a big problem for us: what I did in January and will do again now is call my vendors and tell them to send me every piece of product they have now; I’ll bring in new a little later.

Among our current challenges: finding talented young sales people, and keeping them happy and motivated. Fortunately, one of our stores is near Ohio State University. They have an acclaimed fashion program, and we use a lot of interns.

As for changes in our business: we’re doing far fewer promotions than we used to: just two clearance sales a year vs. monthly. We’ve also cut back on advertising: we’re making more money than ever, so we’ll ride this wave as long as possible.

Mario Bisio, Marios, Seattle Washington and Portland Oregon

During the pandemic, suits, sportscoats and tuxedos were at a standstill but starting last spring, tailored clothing has been strong, driven by weddings, events, and travel. Our customers are out and about with a vengeance!

When the comeback first appeared, we got out ahead of it and went after basics. We couldn’t get enough basic suits and white shirts, but manufacturers soon caught up and came back strong. We believe in keeping assortments fresh, and a model change is due. Although it’s a five-pocket world, a slightly fuller pant looks right: still fitted in the rear but a bit fuller in the thigh with a narrow bottom so it still shows off the sneakers. It takes time but flatfront trim fit suits and trousers have been the norm for 20 years; it’s time to evolve.

Strong business in tailored is encouraging since our sportswear business is also healthy. We’ve planned a great fall season with lots of layering pieces: knitwear, sweaters, vests, technical pieces, lightweight outerwear. Whatever the look, we always suggest a sportcoat or jacket to hold sunglasses, keys and phone, and to complete the outfit.

I don’t want to sound cavalier, but price is not a big conversation for us. The dollar is at parity with the euro, which is good. Plus, we offer good, better, best price tiers in every category so our customers always have options.

Harry Mayer, Meridian, Mississippi

Like most everyone, 2021 was our most successful year in business. We’re celebrating our 50th anniversary this year and we have quite a few trunk shows and events planned for this Fall. Although our business has been very strong, we’re starting to see a little pullback in sales over the past three months. Our YTD clothing business is up 7% and I hope we can maintain this through the remainder of the year. We’ve had no off-price promotions and hope not to.

Our best-selling suits are solid charcoal, modern blues, and black. A few muted plaids do well, but stripes mean nothing. Seersucker and linen suits have also done well. Sportcoats have been limited to about 35 percent of our clothing business only because we can’t get enough tasty coats in the $299 to $599 OTD range. Most of our sales are driven by events. Weddings, interviews, and sadly funerals.

We’re excited yet cautious in planning for Spring 2023. Since the pandemic, we’ve reduced our store hours, reduced our staff, and re-focused our advertising, all with positive results. We’ve definitely been impacted by supply chain issues, especially for sportscoats, basic dress shirts, neckwear and performance knit shirts. Unfortunately, this affected our sales. But we’re growing our website business and hopefully it will continue to gain traction.

Bottom line, I’ve been so blessed to work in a business I love. This is my hobby, and our region really supports us. We have a unique position in our marketplace and as we move forward, we’re editing our merchandise mix to be even more special. We see much opportunity for Spring 2023 and beyond.

Michael Engel, The Foursome, Plymouth, Minnesota

Tailored clothing seems ever more event-driven. Weddings are the driving engine, especially in summer, not just suits for the wedding party, but also for attendees.

I believe the greatest challenge over the next five to 10 years will be finding high quality sales associates. A lot of the career sales associates are starting to retire, and fewer young people want to make this their career. It’s crucial to have great associates to deliver the type of experience we need to deliver.

Thankfully, our vendors have been able to provide most of what we need through these challenging supply chain times. Basics like white shirts and navy suits are sometimes hard to find, but most of our vendors have not been backordered on units for more than a couple of months. We’re thankful for all the hard work they’ve done to provide us with goods.

I don’t see us growing our online tailored clothing business. Our uptick in business is due to the exceptional experience we deliver in store. With department stores less able to deliver service, specialty stores win by default.

So I believe our tailored clothing business will continue to grow not because the market in general will grow, but because there are fewer stores delivering a top quality experience. I believe specialty stores will continue to gain market share due to their dedication to taking great care of customers. This, combined with quality product at a good value, will increasingly stand out.

Jeff Brand, Harleys, Milwaukee, Wisconsin

Weddings/events and business travel are the biggest driving factors in our tailored sales. We do best with $1,000+ price points: Corneliani, Canali, and Trussini. Strong performers under $1,000 include TailoRed (we private label it), Byron, and Jack Victor

We’ve been watching inventory levels carefully, leaning on a ‘just-in-time’ or “buy-now-wear-now” philosophy. We try to buy up credit holds or merchandise that might be a season old at a price. We’ve also been utilizing our custom vendors to develop private label, and this has been very successful. We can go from Design to hanging in the shop in about 20 days. The other important change: we’re working on a larger margin: 65 points for our branded goods and 75 for private label. This helps offset our tailoring costs.

Right now, my biggest concern is the economy. We’ve been enjoying outstanding performance after a couple of challenging years. But just as we’re making headway, we now face a high rate of inflation and an economic slowdown. Hopefully, we can continue the momentum, but it’s certainly concerning and something we’re paying close attention to as far as inventory levels go.

I’m looking for something inspiring these days, a brand or category to wow me. I haven’t had that feeling in a long time; it seems things are so status quo.

I’m not a huge fan of online sales; we don’t do them. There’s no loyalty when it comes to online selling: it’s just a race to the bottom. Where can I find free shipping or who has a promo code? We use our website as a clearing house for unwanted items. It’s hard for consumers to invest in tailored clothing when they can’t touch, feel or try on. So the online rate of return is high.

The key changes I’m making in tailored clothing: watching inventory levels and keeping the selection tight and fresh. Margin, Margin, Margin. I cannot overstate how important that is when it comes to tailored. You must cover yourself. Customers are more discerning re: fit so finding a way to satisfy them while not making them feel like you’re nickel-and-diming them for alterations on a luxury suit is very important. Margin allows you to take care of them in a classy way and still be profitable.

Dan Farrington, Mitchells, Westport, Greenwich, Long Island, San Francisco, Seattle, Portland

I’m still optimistic. Occasion dressing will slow down but most customers have not yet replenished their post-pandemic wardrobes so there’s some good business ahead. I’m worried that the surge won’t repeat itself when this cycle has closed, but I believe we have another good fall and spring season ahead.

Earlier this year, it was about tuxes and basic suits, and we were doubling our inventory to keep up with demand. Now, going into fall, we’ll be more cautious and chase the business. We’ll be less aggressive on basics, and stronger on all the fancy sportcoats. I believe we can match our strong sales figures from last holiday.

Scott Shapiro, Syd Jerome, Chicago, Illinois

It’s tough for resort and secondary market retailers to understanding the pressures city store merchants face who must fight competition from A doors of all the majors (Saks, NM, Nordstrom, Bloomingdale’s) and all the luxury single brand stores. Add to that outlets and custom tailors on every corner and it’s clear there’s tons of product out there!

Clearly, the dynamic has changed. Attorneys in Chicago are moving their law firms to shared space, so business is not turning around so quickly—maybe in five to 10 years. I’m still doing strong business with Canali, LBM, Brioni and other big luxury brands. The manufacturers suffering most are the smaller handmade Italian makers: they can do MTM but not stock.

I don’t believe suit business will ever come back the way it was but that’s okay. The market will adjust: more stores will close, department stores will carry fewer suits, mostly a homogenized mix of the same predictable stuff. So specialty stores gain the advantage. But a bigger question for our industry is this: can the big brands survive without the department stores?

A typical scenario today is this: a guy goes to an event and notices he’s the only one in a suit with cuffs and a longer coat. Styles have changed, he looks dated, so he comes in for a new suit. No matter how hard he works out, he won’t look great in old clothes. So I believe suit business, come fall/winter, will pick up. Summer months are tough: when it’s hot, guys dress down.

Eliot Rabin, Peter Elliot, NYC

Hot items lately: long-sleeve knit shirts with French cuffs from Peru Unlimited: we sold out the first day! Linen sportcoats, fabulous rep stripe ties, linen scarfs, and Lad & Dad matching sportscoats in a superfine wool blend for Bar Mitzvahs, Confirmations and Christenings. Hickey Freeman makes the boys models and they’re selling out at $800.

Craig DeLongy, John Craig, Florida

Year-to-date clothing sales are up +133.9%; we’re planning up 9% for 2023. In general, what’s driving clothing sales this spring/summer are brands including Canali, Munro and Jack Victor. Sportcoats have been on fire at all pricepoints from $895 to $8,000. And our made to measure business has been strong across all pricepoints.

The biggest changes we’ve made since the pandemic: increasing inventories and adding higher pricepoints with brands including Kiton, Isaia, Castangia, PT USA, and Fray. We’ve also increased the depth of our size runs and have added bigger sizes. Quite frankly, we’re in the best place we’ve ever been. We learned so much more about our clients during and after the pandemic. All seven stores (three different brands) have big increases and great management teams.

Our only real problems have been 30-60-day late deliveries out of Asia. Of course, I didn’t ask for discounts from the vendors since this was out of their control. What I now need from the market is a better selection of fancy dinner jackets!

As for selling tailored clothing online, we don’t do it now and have no plans to do it in the future. Beyond that, my five-year crystal ball is very cloudy.

BJ Stringham, UWM, Salt Lake City, Utah

Our tailored clothing business year-to-date is up about 30 percent over last year.

Tailoring is our biggest challenge by far. We’re training tailors, but it’s difficult to find them.

We also need more private label options.

Supply chain has been a bigger problem this year than last, especially product coming from Canada. We do no online sales and don’t anticipate doing it any time soon.

Lindsay Morton Gaiser, Andrisen Morton, Denver, Colorado

Our YTD clothing sales are up 83%. Our plan for 2023 is flat for all tailored categories. The return of the suit has been huge for us with increases in this category of triple digits. Our customers are moving away from wanting basic suits. They really want something unique and different in suiting. Suits from all our large collection vendors like Zegna, Kiton, Canali and Isaia have been the drivers of this. We experimented with some suit separates for spring 2022 and our market reacted positively to this as well.

The biggest change we’ve made on the merchant side is our markdowns. We learned through the pandemic that we didn’t need a lot of sales to drive business. Very simply, to drive business without a markdown incentive we need to keep our inventories clean and lean, and our salespeople motivated. We all know what happens when we don’t take a lot of markdowns and manage our inventory, right? We make more money!

What keeps me up at night is another compression in the market, but we remain positive. Also, the aging of our sales team. It’s harder and harder to find people who are passionate about our business, so we’re constantly searching for new talent!

Our business has been impacted by supply chain but who hasn’t? Our vendors have been amazing partners through this, and we are very grateful! But the one thing I’d love to see in the market is newness: something fresh, different, and high end. I’m always on the hunt for something I can get excited about bringing back to Denver!

Michel Duru, Shrewsbury, New Jersey

Our overall business is up 41 percent from 2021. Our clothing stock business is up 30 percent but the average per unit price dropped since we sold less expensive suits for wedding parties.

Selling best now in tailored clothing: Sportcoats from all brands at all pricepoints, our own branded safari jackets at $895, wedding suits from Renoir. A related standout: private label easy-care dress shirts with colorful buttons and threads that we also offer in custom. In 12 months, we sold 1400 units.

Since the pandemic, we’ve doubled down on our tailoring service. (People need lots of tailoring post-pandemic!) And interestingly, more then 31 percent of our post-pandemic business has come from new clients!

What keeps me up at night: negative news from the media, Covid issues and staffing. Although we’ve cut back on events, we’re always reaching out and sending personalized messages with photos to existing clients. We’re big on Instagram with wedding pictures and we advertise in bridal magazines. We’ve been able to sell without price promotions, which has really helped the bottom line.

My crystal ball on tailored clothing: Now that live trials will be starting in September, my Wall Street guys will be spending three days a week in NYC and will need new suits. We’re also making our own sportcoats from our custom suppliers and we’re adding more ‘want’ items to our assortments. Specialty stores need to be special so we’re showing more fashion and customization than ever.

Thank you for the Great, Positive article. Very refreshing. We are experiencing many of the same results in Fort Worth, as in other parts of the nation. Our area is experiencing growth like never before, as is our store. The Fort Worth Stockyards has become a great destination, and we are positioned right in the heart. Good to be in Texas.

Thank you Mark! Would love to learn more about your business— and happy you appreciated the feature!

Karen

You really should make the short trip over to Ft. Worth to see them when in Dallas. A truly class act.