INSURANCE ISSUES

by Karen Alberg Grossman

Mar 24, 2020

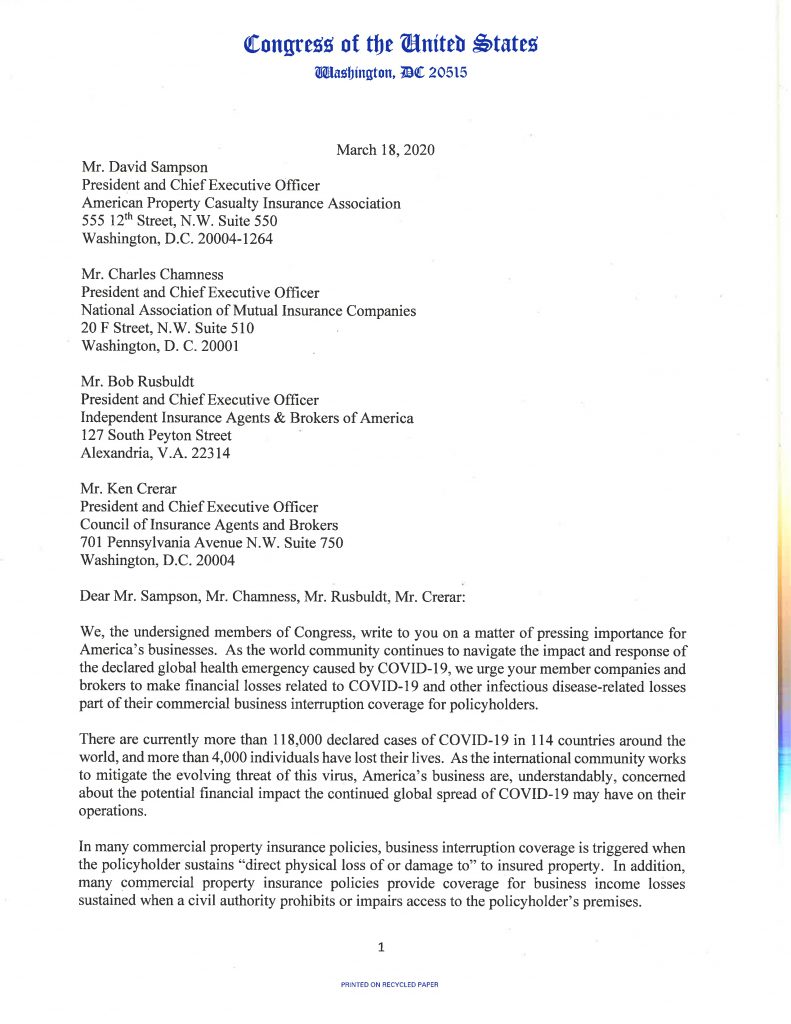

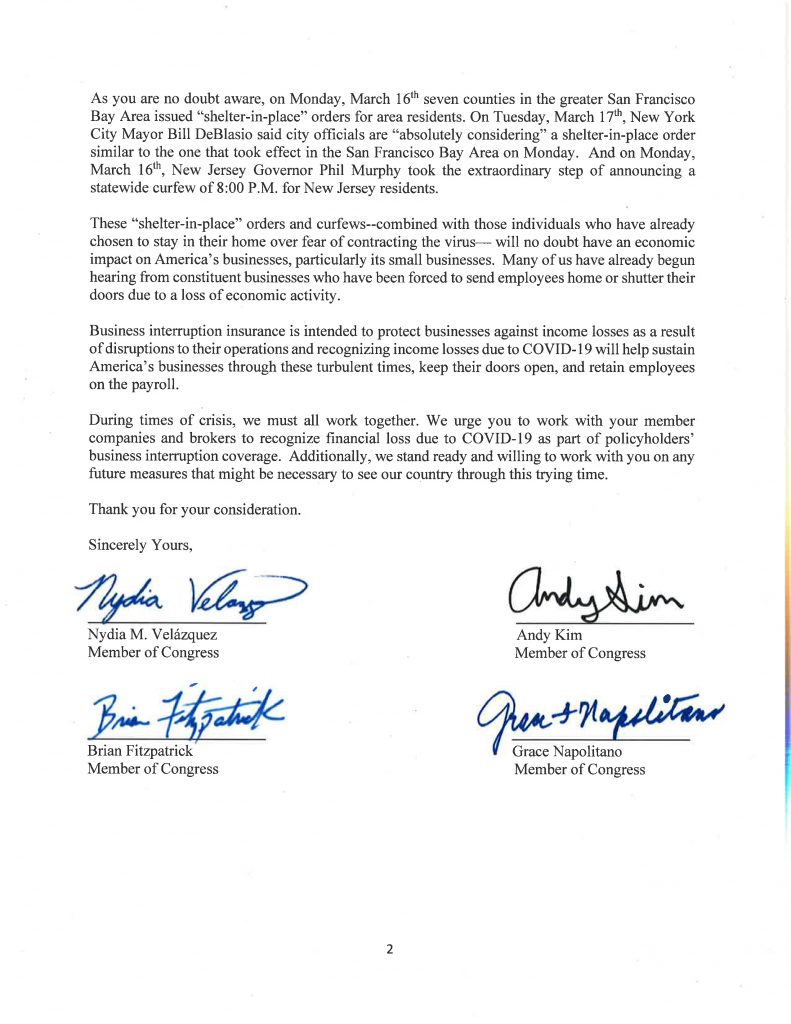

What’s the point of Business Interruption Insurance if it doesn’t cover government-mandated store closings? Last week, Philadelphia-area retailer Frank Ventresca contacted his U.S. Congressmen and won their support, as indicated by the letter that follows. He suggests that all retailers with this type of insurance work with their congressional representatives to ensure coverage. If this pandemic isn’t a tragic business interruption, we don’t know what is.

Good work Frank,

Mike Smith

CEO- The Custom Shop Clothiers

I also checked my policy with the hope of coverage, and found a clearly written clause in the policy which specifically excludes losses to to virus. This is apparently a standard clause in all policies. Although it would be a great relief for us policyholders to have coverage for this disaster, without insurance companies doing underwriting for this coverage, and appropriately charging higher premiums for it, a payout would undoubtedly bankrupt the insurance industry. Even though we’d all like it, there ain’t no free lunch!

Good job , Frank. Just spoke to my Insurance broker yesterday about this. Let’s stay creative.

Rush Wilson III—Rush Wilson Limited, Greenville, SC

Last week I spoke with our agent and he told me we wouldn’t be covered.Today I forcefully requested my insurance agent to file a claim with the carrier. He did so and I have a claim number. We’ll see what happens. I don’t know what will happen but at lease I would have is a formal denial from the insurance company that I can use with my congressional delegation to wave at the hypocrisy of the insurance industry.

I encourage my retail family to apply for whatever loan or help you can. The worst they can say is No.

We have the same issue. I would like to echo Joe Pastor above and encourage all to make sure they submit claims to their carriers even if only to create a trail of denial. Reach out to your Congressman to support this bill and thank you Frank for getting this started.

We filed a claim with our carrier last Friday; Monday, I received a call from an adjuster telling me that we weren’t covered. Congress should put some pressure on insurance companies to pay something.

Gerhard & Elisabeth Bendl

Custom Shirts of La Jolla

Bendls

Since 1977

Just an update. We were told or claim is being denied. I’m waiting for an official letter from our carrier. Then I will contact our congressional delegation.

below:

________________

We, businesses across industry, of all sizes, and matter of importance have suffered unpreventable loss over the last several weeks. With elected and health officials really unsure of what to definitively do next, many of us are left in a spiral of peril. We know things will turn around, but when. As many explore alternative methods of conducting business, many of those options are not within reach for a relationship business such as mine. As a longtime and respected clothier in Baltimore, I want to see insurance companies recognize the need to revisit language of their insurance agreements. I nor are others looking for something for free, we simply want a relationship that serves the interests of both parties.