NATE ENTERS FINTECH SCENE WITH BUY NOW, PAY LATER OPTION

Nate has entered the FinTech scene with streamlined shopping in mind. Having launched the world’s first universal automated checkout late last year, the artificial intelligence shopping assistant is now simplifying the world of buy now, pay later (BNPL). With one click, consumers will finance their transactions from any online retailer in the United States, without additional fees or sacrificing data privacy. Nate is the first – and only – BNPL solution that is universally available in iOS and doesn’t require any retailer integration or charge the retailer a single cent for its service.

Nate joins the growing FinTech market with a BNPL solution that solves some sobering challenges of the industry’s generic business model. Instead of paying for the service with hidden fees or personal data, users pay an affordable and upfront $1 convenience charge for every transaction. The only fee Nate ever charges is $10 to reactivate a transaction after a “pay later” installment has been returned.

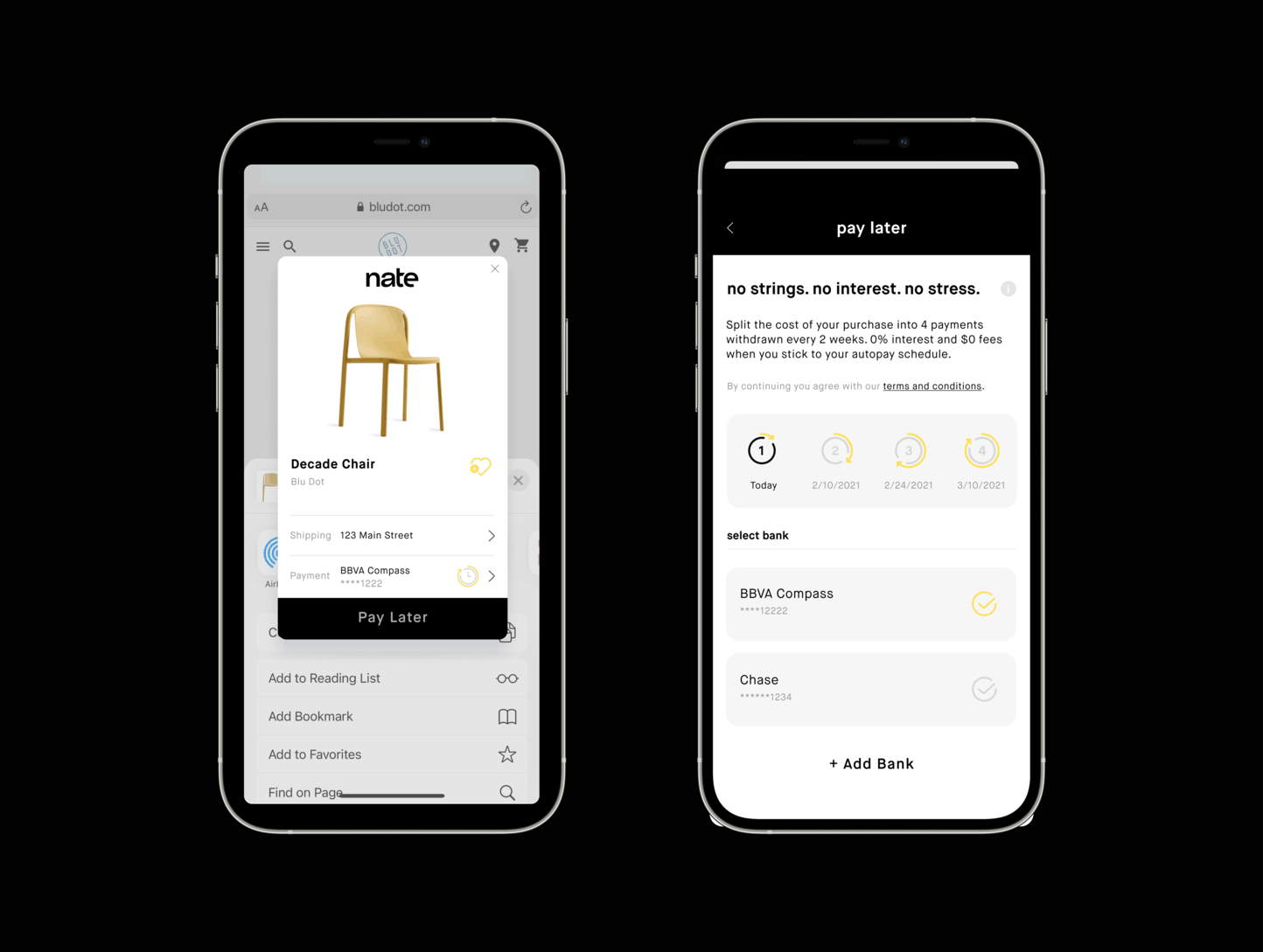

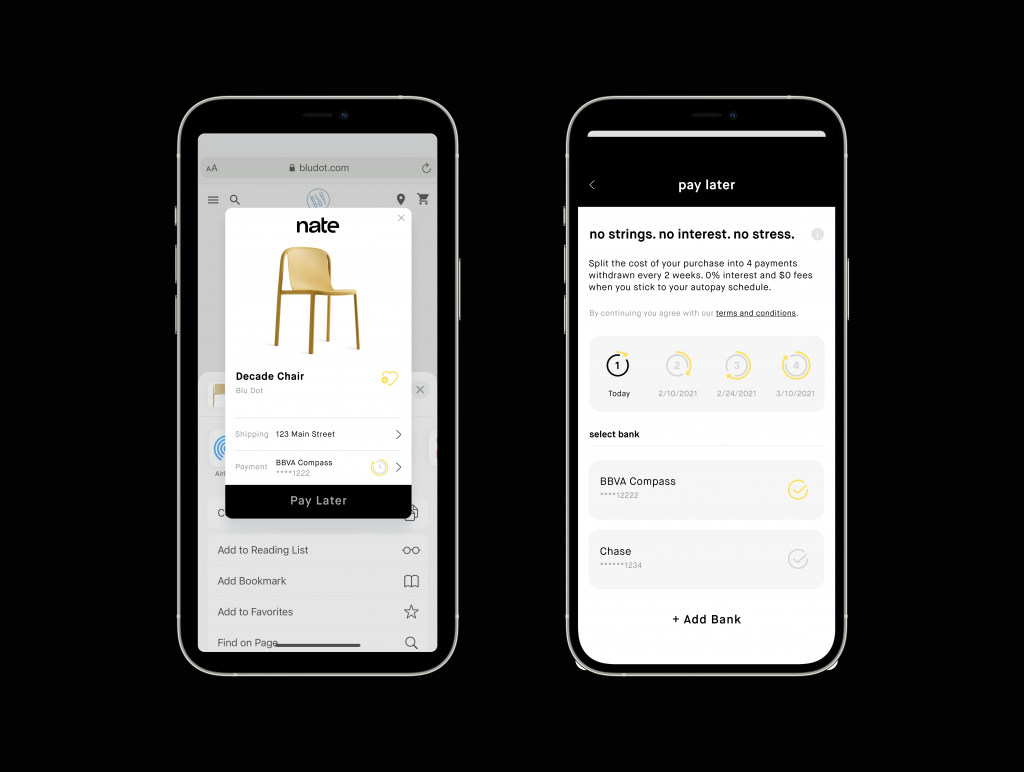

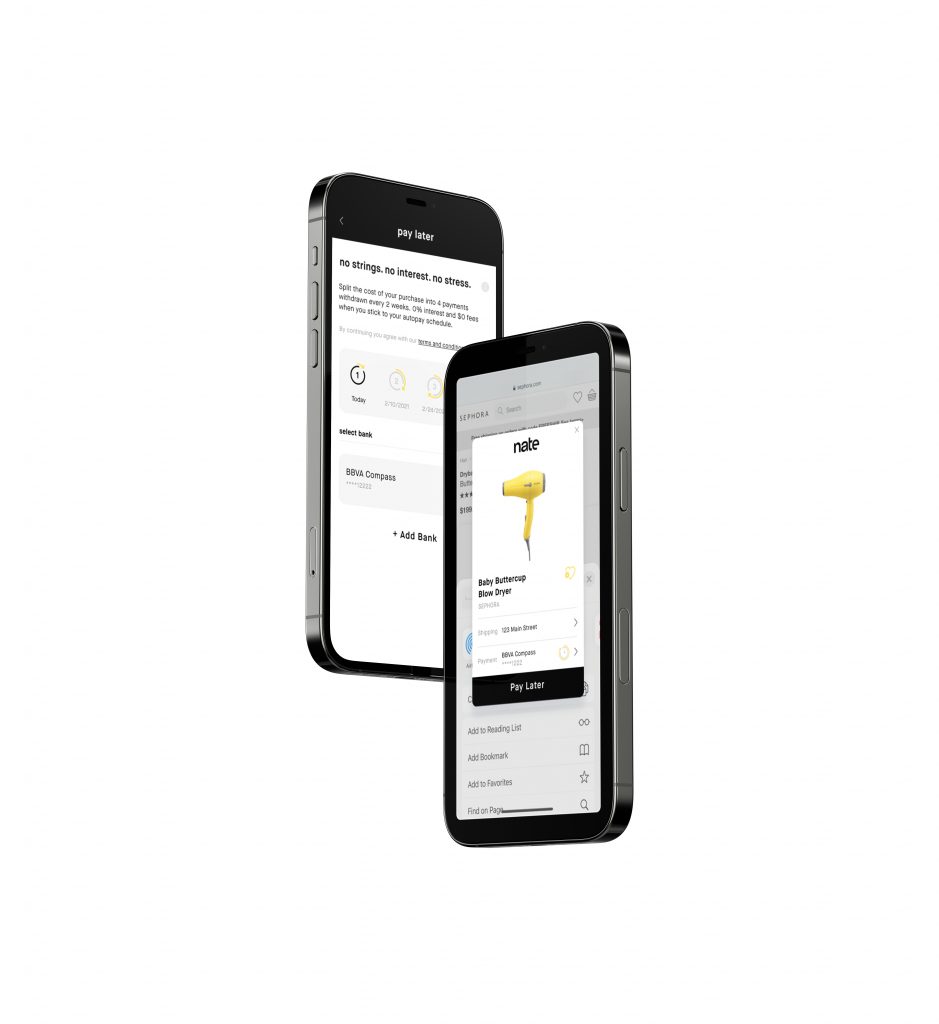

Originally launched in October, Nate’s “Buy Now” feature was designed to be intuitive and easy, enabling a shopper to stay in flow. Once a user has chosen what they want to buy, they share the web page with Nate from Safari. One click later, Nate purchases the item, automatically applying any publicly available discounts in the process. That’s it.

Users can also purchase gifts through the app. A friend claims their gift through a shared link where they input a preferred shipping address. If a user isn’t ready to make a purchase, they can save the item for later, adding it to a shareable and shoppable list.

Now, consumers will be able to finance transactions by selecting “pay later” when buying through Nate. As simple as its “Buy Now” feature, a shopper’s payment is split into four installments without interest or additional service fees. With a single click, Nate pays the merchant immediately in full and charges the shopper the first quarter of the total cost. Users pay the rest of what’s owed once every two weeks in three additional installments. Consumers embrace full power over financing — finding a transparent, seamless, and privacy-first system.

Like shoppers, businesses also benefit from Nate’s approach. Its intelligent automation makes paying later possible with any purchase in the U.S. and requires no integration with retailers. Merchants already struggling with their margins, especially during the pandemic, avoid adding another fee to the books, all while gaining more businesses. As customers buy through Nate, merchants experience improved conversion, an expanded customer base, even more intuitive shopping on their social channels.