Q1 ESTIMATES SHOW LIKELY SHRINKING OF US ECONOMY

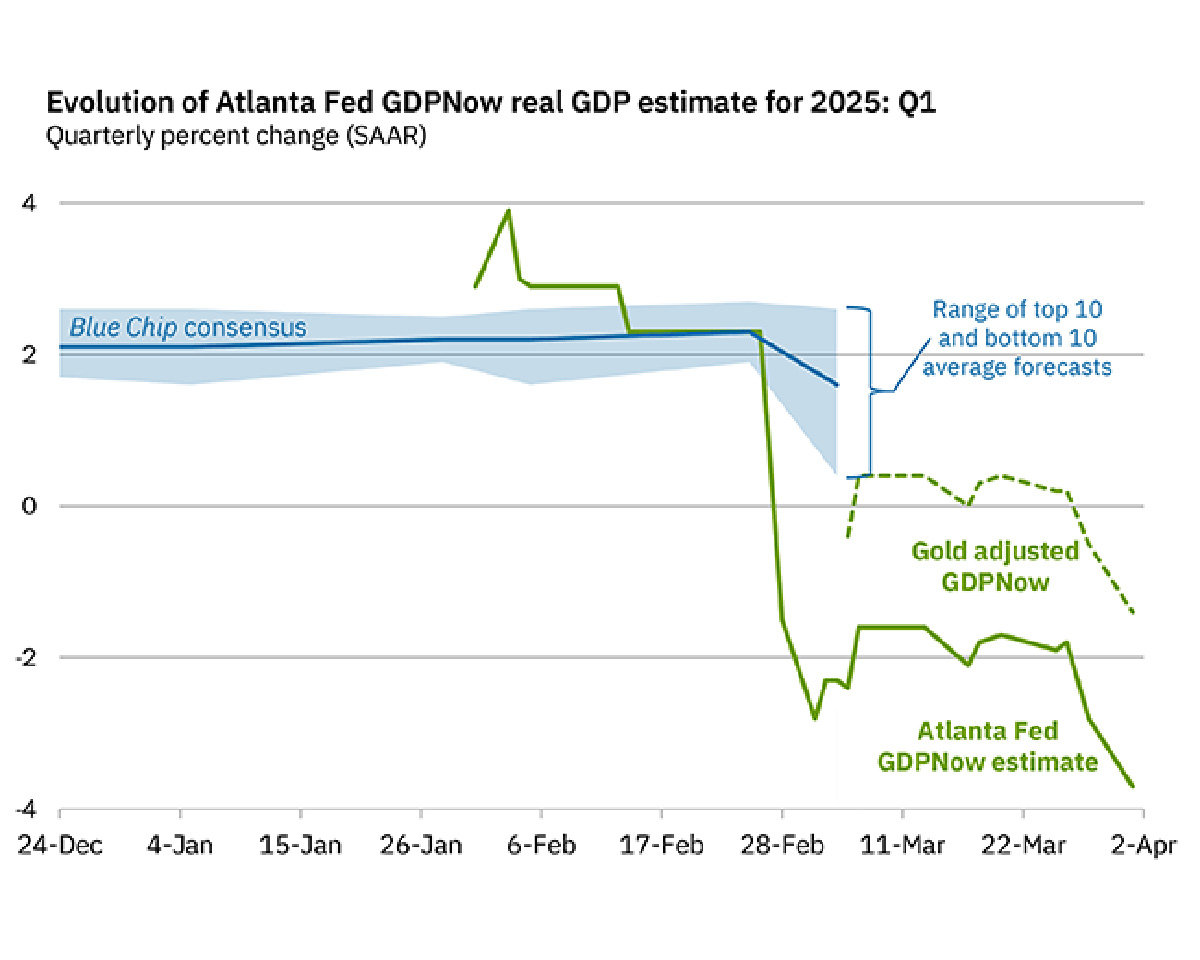

New estimates of Q1 consumer spending and GDP numbers reveal a slowdown in the US economy and spark predictions of a recession. Consumer spending, as measured by the Conference Board, showed that following Q4 2024 gains of 4%, Q1 2025 has declined to 0.2%. Coinciding with this, the estimated GDP for 2025 was on target to reach 3.6% and has since fallen to a revised -2.8%.

This is all in the presence of a return to rising inflation, which has increased from the Q4 low of 2.4% back up to 3.1%. These economic changes are largely being driven by the current administration’s conversation about imposing tariffs on the US’s largest trading partners, Canada, China, and the EU.

“Stockpiling ahead of potential tariff implementation on a wide range of consumer goods could lead to a pullback in goods spending later this year,” a statement from Conference Board Senior U.S. Economist Yelena Shulyatyeva said. “Such a swing reflects tough choices consumers are facing amid rising prices. Consumers will likely become even more cautious and tighten their purse strings further if inflation continues to rise.”

The PCE (personal consumption expenditures), which excludes food and energy, measured at an accelerated 2.8% annual rate in February from 2.6% in January. The Fed aims to curb inflation at 2%. Early indicators have indicated that the inflation rate has continued to rise and now sits at 3.1%

Shulyatyeva went on to say that the PCE “is likely just a precursor to sharper increases in the coming months as tariffs make their way into consumer price data via either a direct impact or on the back of rising inflation expectations. Barring de-anchoring of longer-term inflation expectations, we anticipate that the negative impact on growth will likely overwhelm the impact of higher inflation, resulting in the Fed reducing policy rates in Q2.

US Fed officials on March 19 downgraded the American economic growth forecast for fiscal year 2025 to 1.7% from 2.1% in December, and other organizations have reported more bleak estimates. The unfortunate answer to “what will happen next ” remains unclear as the current administration’s unpredictable nature has already seen sudden full reversals, delays, and escalations of trade policy. This instability, however, can likely be relied upon to sow deeper mistrust in consumer confidence.