SHINING STARS: PART TWO OF OUR INDEPENDENT STORE SURVEY

In part 1, specialty retailers shared their Mission Statements, Winning Strategies, Top Brands, Key Challenges and Current Goals. Here, we learn their Online Opportunities, Event Strategies, Supply Chain Suggestions and more. We thank all our retail respondents for sharing their ideas, which will surely inspire and strengthen our entire menswear industry.

Online Opportunities

Yes, it’s 2023 yet 57 percent of surveyed independent store retailers do no business online; 70 percent of these have no plans to add an online component in the immediate future. Among the 43 percent who have ventured into it, online contributes an average 3.6 percent to total sales, ranging from 1 percent to 25 percent, according to store.

Some comments here are revealing: “The brick&mortar client experience is our continued focus.” “It’s not worth the effort: the online customer buys directly from the brands.” “We will continue to focus on what we do best: connecting with customers in-store.” “We’re happy with our website, which drives in-store traffic.”

Yet most of those respondents who have dabbled in online selling are planning to intensify their efforts. Says David Hodgkins at David Wood, who does 8-10 percent of his volume online, “We plan to grow this, and add more made-to-order.” Says Andy Mallor at Andrew Davis, “We recently revamped our website with Shopify. We view it as an opportunity to grow our brand and expand our reach, especially for collegiate apparel (Indiana U by Johnnie-O and Peter Millar) and niche sportswear and footwear brands.”

M.J. Daswani at Daswani Clothiers in West Hartford Ct does about 10 percent of his business online but admits it’s “time-consuming and challenging to personalize our store as a platform for the world. We operate like digital dinosaurs, facetiming with customers, showing them product via text, but making the transaction in-store. We’re about to try a digitalized catalog instead. Should this pilot be successful, we’ll try for an online store through an app.”

Says David Perlis, who does 7.5 percent of his business online, “Much of this is private label logo business but we’re working to get more branded product online.” Says Todd Christiansen from Journeyman, “We’ve contracted with two agencies to help us drive online strategy and create content. We project 25 percent of our business to soon be online.”

Mississippi merchant Harry Mayer represents the still-cautious contingent. “We’ll maintain our 4 percent online, but once we burden all the expenses necessary to make online selling successful, we don’t actually make money on it.”

Creating Buzz

Respondents’ creative ideas for events and advertising could fill a book but here are a few of our favorites. From Keith at Kinkades in Jackson Mississippi: “In recognition of April showers, we give away logo imprinted golf umbrellas. In May, there’s a promotion in honor of my birthday. In June, we take out a full-page ad in the local newspaper featuring a collage of photos of our customers with their dads. (This in honor of my dad, the late Shelton Kinkade, who had a tremendous impact on my life, teaching me to always do what’s best for others.) Holiday promotions include homemade pies for customers prior to Thanksgiving and cinnamon rolls before Christmas. In addition, there’s a Ladies’ Day promotion the week after Thanksgiving, a holiday open house, and the very popular photos with Santa.”

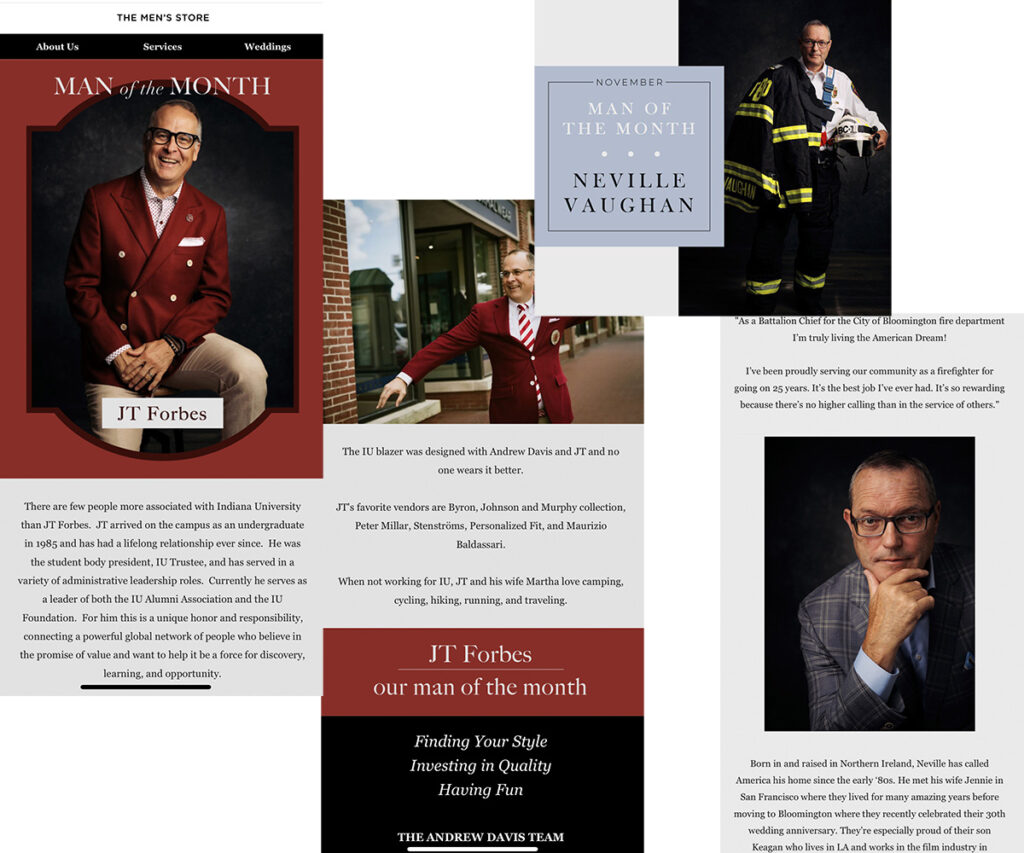

In addition to his Man of the Month promotions (featured above), Andy Mallor runs an Andrew Davis Man campaign every few years. “We photograph our customers decked out in Andrew Davis clothing, noting their profession and interests. We also run billboards with the slogan “It’s Time to be an Andrew Davis Man” featuring a photo of a well-dressed customer looking at his watch. People continue to ask us how they can become an Andrew Davis Man…”

Geoffrey Michel at The Met believes in showing customer appreciation. “We recently gifted monogrammed ice cube trays along with a bottle of their favorite spirit to thank clients for their referrals. They’ll remember our appreciation with every sip and will tell their friends where they got the monogrammed ice cubes…” David Rubenstein had much success with a whiskey tasting for The Original Bourbon Club, proceeds going to Real Men Wear Pink to fight breast cancer. “It was mostly a social event that drew a young crowd. People were excited to be out and about, and we sold lots of merchandise!”

Dennis at Palmettoes formed a great relationship with two regional magazines that now feature his apparel in their fashion editorial. David Wood does well with a Makers event “showcasing three or more artisans while fueling customers with beverages and snacks from local purveyors.” John Braeger at Garys did well with a Super Client night: “A top client brought in a group of friends for a private evening of food, drinks, and learning about the store. We had advance notice of their sizes and tastes; they shopped the entire night, had a great time and bought lots of stuff!”

Tom Malvino sponsors an annual professional golf tournament “widely supported by our vendors and well attended by customers, friends, and golf enthusiasts. Revenues are donated to our local Little League.”

And at MP3 for the past five years, more than 200 guests attend an All Black Attire Men’s Runway and Fashion Show. “It’s open to the public and showcases our fall menswear collection. We serve cocktails and light bites before and after the show to the tunes of DJ Cousin Christopher. We’ve also had success with our Isaia in the Alley trunk show—a private party for Isaia customers. Models showed off Isaia’s latest fall collection; guests enjoyed wood-fired Neapolitan pizzas, classic Italian wines and Aperol Spritzes while a local pianist belted out fan favorites.” Sounds like a great party!

Next Generation

A definite goal for most merchants today is attracting young customers, guys who might not buy the big ticket stuff today but who will hopefully become the big spenders of tomorrow.

How to entice them into a physical store, a generation that grew up online? Offering more youthful product, hiring younger sellers, and staying active on social media are obvious answers, but there’s clearly more to it than that.

Nick Hilton is working to better communicate his decades of experience by explaining quality fabrics and craftsmanship, noting that a portion of young guys seem truly interested in learning. He tries to offer genuine information without hype and is also marketing to brides-to-be. Todd Christiansen at Journeyman has intensified his local advertising and university outreach. Notes David Rubenstein, “We need more brands like Munro to introduce young guys to quality men’s tailoring.” Says Wally Naymon Kilgore, “We strive to bring a modern sensibility to each of our vendor assortments, discussing with our style advisors the direction of our buy. Knowledgeable staff that understands ‘modern’ attracts clients who want something different. This generally means young…”

From Andy Mallor at Andrew Davis: “We have a very young staff, including interns from the Kelley School of Business at Indiana U. This helps to immerse the store in a youth culture and refreshes my thinking about merchandise and merchandising.”

From Tom Malvino at Louis Thomas, “We’re finding young clients are appreciating old-school attitudes. Channeling their grandfathers, they’re buying pocket squares, lapel embellishments, braces, and cool hats. The right collections can appeal to multiple generations. Another suggestion: we’ve sponsored local Little League teams for 60+ years. These kids grow up and remember you: I just did the wedding for a guy who was the catcher on our 2005 team…”

At Perlis, David Perlis credits his boys’ department for increased sales in men’s. “Those boys become young men and they (or their parents) remember us for special events and proms in high school. Formalwear rentals also lead to future customers. Stocking more slim-fit suits and dress shirts at opening pricepoints is another strategy that works. But word-of-mouth referrals based on our selection and service are what matter most.”

Keith Kinkade from Kinkade’s in Ridgeland Mississippi agrees. “We make a concerted effort to bring high school students into the store. Introducing them to brands that are worn by their friends means they’ll usually return through college and beyond. I have two high school-aged boys, so I see what their friends like to wear. I printed up some logo sweatshirts last year and they’ve taken on a life of their own! These kids come in the first time for a sweatshirt, shorts, or athletic wear, and next time bring their grandma to buy them a sportcoat for homecoming or a suit for college. Next thing you know, they’re back to outfit their groomsmen!”

Adds Dennis Jaworski at Palmettoes, “We try to bring in new brands that already have a strong following among young guys. My son convinced me to try The Normal Brand and we’re selling it well.” Says John Braeger at Gary’s, “Our young customer base has been growing for the past two years, much of it from the surge in weddings. The brand Munro has been the leader for us: the pricepoints, styling and technology have inspired our staff and our customers.”

What We Need…

What do retailers need from their suppliers that they’re not getting? Retailers were far from shy in their responses. Says Nick Hilton, “Brands need to supply better photos of real-looking men wearing their clothing, images we can use on our websites and email blasts to market their product. We also need in-season access to in-stock information. And please: stop with the minimum order requirements!” Steve Bratteli has a different request. “We need vendors who offer specialty store merchandise that can only be purchased in specialty stores. Our vendors are by far our biggest competitors.” Jim Ockert suggests that vendors not be afraid of unique piece goods.

Geoffrey Michel from The Met would like electronic ordering from all his vendors. “We love great showrooms and beautiful product but when it’s time to buy, make it simple. We do fill-ins from our phones on Nu-Order. I have a few vendors who hand-write and it makes me crazy!”

Rick and Jim from Puritan would also like vendors to offer digital platforms for reorders. That, and shorter lead times for placing advanced orders.

Greg and Dana from MP3 are also big fans of online ordering. “The continued expansion of

B2B platforms has been a tremendous asset. It saves time and allows buyers to bring together a merchandising story with detailed records of past seasons. The more brands that adopt these platforms, the faster we can work through orders. While nothing replaces selecting product in person, we often need to revisit assortments and complete orders after we leave the showroom. These tools allow us to instantly dive back into the collection.”

Other practical ideas: Howard Vogt from Rodes suggests that brands give retailers a single point of contact to handle customer service needs. The team at Peter Renneys suggests better in-stock programs so retailers can fill in on-demand. “These programs were much more reliable pre-Covid. We understand the recent supply chain situation, but still…” Scott Moorman also wants better deliveries, especially in tailored clothing. “In November, we still hadn’t received half of our fall ’22 sportscoats; our biggest vendor was more than a month behind. At the very least, suppliers need better communication.” Marshall Simon at Gywnn’s has only two requests for vendors: “1)Deliver on time, and 2)Don’t markdown too early.”

On another topic, one that could fill a book, David Perlis notes that “Going to market has become a bit of a challenge in NYC. With vendor offices and showrooms all over the city and no single destination for trade shows, it’s not easy covering the market. Things were evolving this way pre-Covid and unfortunately, it’s gotten worse. Chicago and Dallas have become better shows, although I miss what New York used to be.”

A few more logical suggestions: Steve Rubin at Josephs in San Antonio suggests vendors provide “more efficient shipping and consolidation.” John Pickens would love vendors to “partner with us on training our sales staff and on co-op marketing.” Jim Ockert dreams of wholesale prices that afford higher initial markups. “We’re bombarded with extreme cost increases, including alterations and shipping. Being a merchant is more than just buying beautiful product; it’s about making the numbers work.” Ken Metzger has a simple wish: that vendors would talk to their retail partners. “The industry no longer communicates,” he observes. “We hear from our vendors twice a year: for market appointments…”

Andy Mallor would like more vendors to focus on the why. “Why should we by buying this line over the others? What distinguishes it? Give us info that would allow us to keep communicating the why to our staff and customers.”

Scare Tactics?

Virtually all survey respondents are hopeful 2023 deliveries will be better than last year, but few are expecting perfection; most are working with their vendors to get orders in early although several worry that vendors might be using scare tactics, demanding far too much time between order placement and delivery. But is the solution to do more business with fewer brands (thus becoming more important to each) or to spread the wealth among numerous brands (thus increasing the odds that at least some will ship on time)?

Says Keith Kindade in Ridgeland, Mississippi, “It seems each season vendors are asking for orders earlier and earlier, reacting to the previous season’s delivery problems. We try to place orders at market when we can see product, ask questions, and set aside time to write. Some vendors want orders even before we get to market which is challenging. Having a good relationship with vendors makes it easier to meet such requests.”

Geoffrey from The Met understands that “early buys are important to vendors due to legitimate concerns about international production. We’re happy to work early with our vendors to ensure a steady flow of goods.”

David Rubenstein in New Orleans has begun altering buying habits. “We placed early for Spring ‘23 and again for fall as it might be the only way to guarantee deliveries in season. We’ll use second deliveries to fill in what’s missing…” Rick and Jim at Puritan note that “increasing lead times is not a great model for vendors or retailers but we understand that this is necessary with the current supply chain situation.”

“We do not plan on placing fall early,” note Greg and Dana from MP3. “Supply chain issues have been felt in every sector of retail for the past two years. When goods deliver late, it always puts pressure on the retailers. With customer demand exceeding expectations for the past several years, those suppliers that deliver in full early in the season have risen to the top. It’s all about speed to customer: brands that are being creative and delivering early are getting more business. Our customers shop early in the season; we don’t see that trend changing. That said, we greatly appreciate transparency from our partners, and not overpromising delivery dates.”

Says Tom Malvino from Louis Thomas, “The trick is to have multiple suppliers for problem categories and stay connected with your vendors.” Carlo Agostino from Natale’s Men’s Clothier in Norwell Mass (who took over the store at age 32 when his dad, a master tailor from Italy, passed) agrees. “I’m not placing goods early: I’m not focused on any single vendor; I can fill in with others and have late shipments arrive in the winter months when I need cold-weather goods. It seems like late deliveries are the new normal.” Neenu Choolani from Peter Renney’s in Portland Maine is buying more upfront than in the past. “We’re buying in anticipation of larger sales and consistent growth. In-stock programs have not been reliable and if we don’t buy early, we can lose out in season.”

Wally at Kilgore Trout agrees. “With supply chain issues in mind, we made fall ’23 commitments mid-December. In tailored clothing, this strategy represented about 70 percent of our buy. I’ll know on November 1, 2023, how good a move this was.”

Cash is King

According to virtually all surveyed retailers, cash has been flowing in the right direction. Responses on cash flow ranged from good, steady, and not a problem to solid, excellent, and never better. Says Greg and Dana from MP3, “We manage conservatively, thus our cash flow has remained good. If we see an overall market downturn, we’ll buy less, assuming our customer demand drops too.”

David at David Wood is optimistic, believing that so many new wardrobe options should stimulate purchasing. He projects fewer price promotions and more promoting new ways to dress. Says Carlo Agostino at Natale’s, “Cash flow is very strong: I’m buying less upfront than in 2019, filling in when needed. I’ve learned that I cannot be everything to everyone so I’ve cut out the inexpensive items, letting my competitors take that business.”

Marshall Simon at Gwynn’s says his strong cash reserve position means he’s far less aggressive with markdowns. Steve Rubin at Josephs San Antonio confides that they’ve not offered in-season price promotions in the last two years. Says Wally from Kilgore, “Covid required us to look at every expense line item. With that discipline combined with volume growth, our reserves have never been so robust.”

That said, retailers understand that recent economic forecasts appear tenuous and that nothing is guaranteed. “It’s critical to control inventory and be disciplined,” notes David at Perlis, “since business is likely to soften with an economic downturn.”

Andy Mallor at Andrew Davis remains cautiously optimistic, ever focused on change. “Be aware of where the industry is heading. It’s always in constant motion, with new resources, new opportunities. We can never take anything for granted: we’re dancing with the marketplace and the music is always changing.”

We have invested in online and have had a website since 1997. We currently do over 35% of our seven figure volume through that channel. Every day we are shipping all over the country with footwear being the biggest category, but our website is also our windows and makes it convenient for our clients to browse our store when they can’t make it in.