SNEAKER INFLATION: THE TREAD IS JUST TOO DAMN HIGH

Sneaker prices are surging in the United States, and that’s challenging news for what has become the footwear of choice in our new normal, post-pandemic, comfort-oriented world: These days, the sneaker is the new dress shoe. Depending on the style, what was once strictly worn for a run, at the gym, or swapped with a pair of cap-toes for the commute home, is now as ably paired with a suit as any dress shoe in most circles. “Air,” the Amazon and Warner Brothers blockbuster movie with an Oscar-winning cast tells the story of the birth of the Air Jordan, practically a footwear category all its own. But is our footwear of choice becoming a luxury purchase?

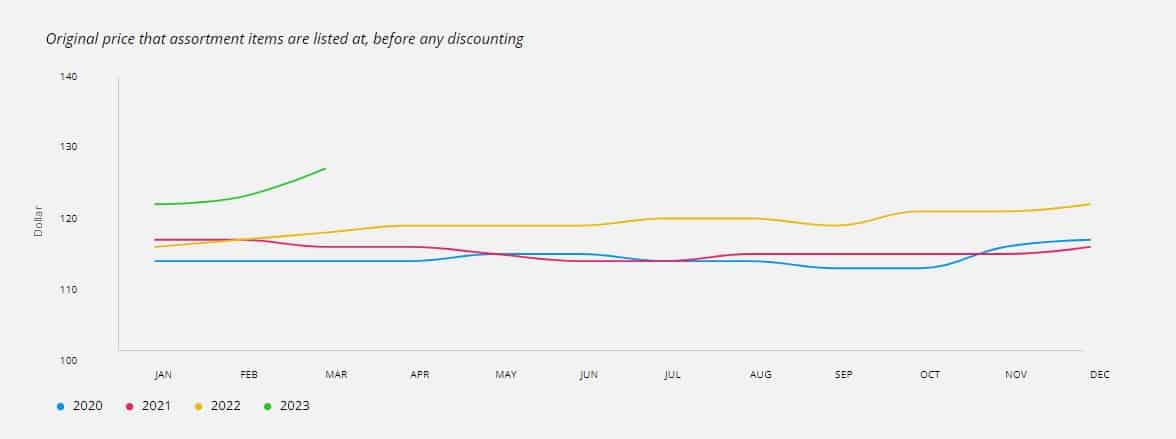

According to new data released from Centric Software, average sneaker prices have surged to record levels in the USA, rising by 12.3% since the turn of the decade, according to the company’s Sneaker Market Index. That rise shows no sign of slowing, either, as sneaker prices in have increased by 4.3% since the start of this year. Item prices averaged $126.89 across the category in March 2023, according to the latest data. Sneakers are currently priced $9.07 higher for consumers on average, compared to the same period last year. Record price levels in March 2023 follow significant price increases as seen during 2022, as average sneaker prices rose by 4.6% over the course of that year.

All of this data has been compiled by the competitor benchmarking, pricing intelligence and trend forecasting platform Centric Pricing, following the launch of its Sneaker Market Index. Detailed market insight is gathered weekly from ecommerce listings to reveal category pricing and discounting levels.

The index has also found that retailers and brands are increasingly having to turn to discounting to shed excess inventory, while shielding consumers from further price increases. Product discounting data highlights that the depth of discounting in the USA sneaker market reached its highest average since March 2021. Over the last two quarters (Q4 2022 & Q1 2023), the average discount per item has increased by 42.7% year on year.

Commenting on the USA Sneaker Market Index data, Centric Pricing expert Elizabeth Shobert says, “The data throws up some interesting trends. Brands and retailers are pricing sneakers higher and higher, which is not surprising when we consider the wider context of inflation and its impact on raw material, shipping, and energy costs. However, higher original prices are not being followed by sales at full price as consumers face discretionary spending pressure.”

“The breadth and depth of discounting in the USA sneaker market is noticeably increasing,” Elizabeth Shobert continues. “Brands and retailers are being pushed to drop prices to move aging inventory. To navigate the ongoing volatility, companies will need to do a better job at predicting trends and focus more on producing exactly the products that consumers want, and in the right amounts; planning more targeted assortments by channel and store; and using resources more efficiently to control design and production costs.”

Photo, top, by Shane Kell.