MR’S 2021 MENSWEAR SURVEY: DOING MORE WITH LESS

According to MR’s latest survey of independent menswear merchants, 2021 turned out to be a banner year, with sales increases over 2019 averaging 15 percent (and a few retailers actually doubling their business!) Says one such retailer, Craig DeLongy at John Craig with seven stores in Florida, three of them in Naples, “Frankly, I’m shocked but of course delighted about these numbers. Everyone in our company got a bonus!”

Although 25 percent of MR’s sample did not quite meet 2019 figures, most were satisfied with small declines, considering the headwinds they were up against. As for 2022 plans, respondents agree that first quarter can be planned aggressively while quarters two through four should be approached with some degree of caution. Says retail analyst Steve Pruitt, “On a comp basis, it will be hard to sustain last year’s increases. Although inflation alone could lift volume (which would be wonderful), it’s foolish to plan for it.” Points out retailer Steve Bratteli, with stores in Texas and Oklahoma. “Many retailers have sufficiently lowered their costs so the business model is now healthier. We’ve kept our stores full during the pandemic so we haven’t had to chase goods; most vendors couldn’t manufacture to their normal level so it all worked out.”

What’s selling?

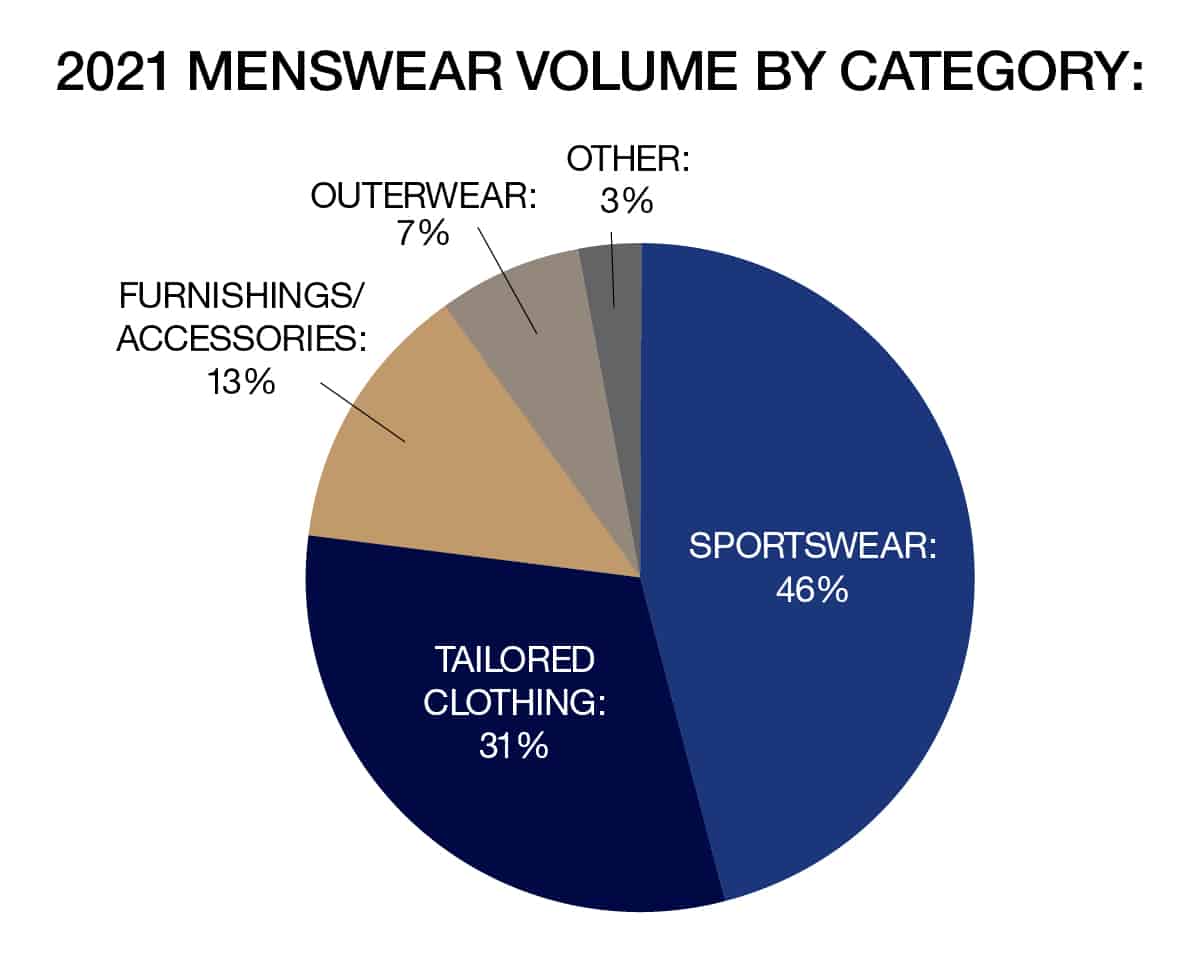

What specifically drove sales in 2021? A return to weddings and other events jumpstarted business in tailored clothing, at the same time that upscale retailers couldn’t get enough luxury sportswear. As most retailers acknowledged, upscale customers had more money than ever: having cut back on travel, entertainment, fine dining, etc., they seemed unphased by high pricetags.

Retailers’ frequently mentioned strong brands included Zegna, Cucinelli, Torino, Fideli, Brax, Stenstrom, Gimos, Eton, Canali, Greyson, Johnnie-O, Peter Millar, Peerless, Samuelsohn, Jack Victor, Coppley, Ballin, Meyer, Brax, Emanuel Berg, Hagen, Gimos, 34 Heritage, AG, Waterville, Maurizio Baldassari, LBM, Hickey Freeman, Normal Brand, Raffi and Faherty. Hot items varied by store but included five-pockets, vests, athleisure, sneakers, outerwear, sweaters, soft sportcoats, woven sport shirts, corduroy anything, custom anything, dress and sport shirts, safari jackets and anything performance. (A surprise holiday seller, according to several DLS stores: coffee-table gift books.)

Writes retailer Steve Bratteli with stores in Texas and Oklahoma, “We’ve seen a rebound in every category: formalwear, sportswear, sweaters, even dress shoe business is back! Our only weak spot was outerwear, but then we’re in the south…” Says Howard Vogt at Rodes, “I’m carrying such different product now than I used to so a category breakdown is no longer relevant. I’m reclassifying hybrid pieces like overshirts, which are strong sellers. Our big push is contemporary sportswear: although several of the brands are priced lower than I’d like, I buy what my customers want…”

Says David Perlis in New Orleans, “Sportswear is driving sales: five-pocket twills and khakis (34 Heritage is bigger than I ever imagined; vanity sizing and stretch help!), Peter Millar and AG are also through the roof!”

Price Paranoia?

Yes inflation is at record highs and apparel prices are already going up but for whatever reasons, many retailers are okay with it. Says Murry Penner in Houston, “In a strange ironic way, scarcity is working in our favor: customers can rationalize higher prices, they’re not looking for promotions, and we can get our margins.”

Yet many, including Scott Shapiro from Syd Jerome Chicago, is concerned about margins. “We need occupancy rates to rise and corporate CEOs to start buying suits again! Yes, we sell sportswear and outerwear from more moderate brands but the margins aren’t there; it’s keystone at best!”

Challenges

Despite recent healthy business, retailers cited a litany of problems carrying over from 2021: inventory shortages, higher prices, not finding great sales help (“especially up against Starbucks’ offers to pay college tuitions”), not enough in-stock programs, not enough fashion innovation, etc. But as retail consultant Steve Pruitt points out, “Retailers who’ve learned to use inventory more efficiently don’t have much to worry about. Stock to sales ratios have improved, margins are higher, supply chains will open up, and they no longer need steep promotions. By doing more business on less inventory, their only valid concern is a slowdown in consumer demand. But rather than worry about it, retailers should focus on the lessons learned.”

But of course, retailers are worrying. Says Rich O’Boyle from Woodbury Mens, “When we buy into in-stock programs, we need to be assured that they’ll be actually stocked.” Howard Vogt from Rodes in Louisville agrees: “Our greatest challenge is staying in stock on timely basics. And we always need more wear-now merchandise.”

But a northeast retailer talks about his biggest surprise: realizing how much more he can do with less. “Especially with print advertising cut to virtually zero and only a fraction of our spend redirected to digital, we’re doing okay!”

Digital Differences

At one major specialty store, e-commerce has grown from 2 percent to 7 percent over the past few years but it’s taken a huge investment and has not yet met expectations.

“Our ecommerce is a small part of our business but continues to grow,” says Rick Penn at Puritan. “For us, an online presence helps drive store traffic.”

“We have no online business,” says Vogt at Rodes, speaking for many. “But our sellers take lots of digital photos and regularly shoot out info to our customers. It seems to be working.”

Retail consultant Marc Weiss from Management One is a strong believer in ecommerce for independent stores. “Stores that have spent the time building digital are doing well. For 30 years, I’ve believed that success is about having the right people and the right product. I’ve recently added the right marketing. Content marketing drives business. It’s a necessary investment.”

Retail consultant Steve Pruitt from Blacks Retail takes a different stance: “Online is not the answer for most specialty retailers. Virtually all their vendors do a healthy share of business online; how can smaller independent stores possibly make it meaningful? Even some larger retailers who heavily invested in ecommerce have not yet made a dime. They’re better off focusing on the basics: control inventory, control cash flow, take good care of your customers.”

Innovation Wanted!

While few menswear merchants are looking for dramatic model changes and fewer are backing the oversized androgenous styles shown on fashion runways, most are hoping for at least some innovation. Says Steve Bratteli, “Clothing has become much too basic: the biggest excitement is black in suits, and navy in outerwear.”

Pruitt notes that it’s been tough for vendors during the pandemic. “Innovation and creativity have been drained out of the business. Designer are no longer travelling to Europe and Japan, so it’s more difficult to come up with fresh ideas. They need to invest more in R&D and provide a constant flow of innovative product.”

Says Murry Penner, “I’m hoping more vendors will take stronger positions for fall ’22, honing in on and backing up what they strongly believe in. Gone are the days when they can simply sell it all to Neimans and Saks…”

Silver Linings

“Learning to operate in times of great uncertainty has been the one blessing from the pandemic,” says Jim Penn from Puritan. “We had to learn to adjust sales plans from the lows of 2020 to the better-than-expected results of 2021. The words pivot and fluid are now part of our everyday vocabulary.”

“We now have a more cohesive team,” notes Howard Vogt. “Everyone’s doing more, and working well together.”

Says Marc Weiss: “Retailers are learning to fail fast, to take more risks and move on.”

And from Dana Swindler and Greg Walsh from MP3 in Minneapolis: “The key is to stay lean and mean and to get comfortable missing a sale.”

RANDOM PEARLS OF WISDOM

My retail clients tell me they can’t get inventory, they can’t find sellers, their expenses are up, yet they’re doing more business than ever!” Steve Pruitt, Blacks Retail

“Buying a year in advance seems totally crazy when men’s fashion is changing so quickly.” Howard Vogt, Rodes Louisville

“Customers who were previously buying sportscoats are now buying luxury sweaters and sportswear. Thousand-dollar pricetags are not scaring them.” Rich O’Boyle and Jim Foley, Woodbury Mens, Long Island

“Business came back like a flash, as if someone just turned on a switch…” Ed Boas, Lanes, Miami

“I’ve definitely traded up. My customers drive Bentleys and own second homes worth $30 million; why should I let them buy a $900 sportcoat?” Craig DeLongy, John Craig, Naples and Winter Park

“Many major brands are dropping wholesale altogether: they no longer believe in the wholesale model, no matter how big our order is.” Luxury Merchant

“There were advantages to leaner assortments: retailers were able to sell the ugly ties they thought they’d never getting rid of…” Steve Bratteli, Bratteli Family Stores, Texas and Oklahoma

“An under-reported challenge: huge inaccuracies in invoicing. Vendors don’t have warehouse help so we have to spend twice as long reconciling invoices.” Midwest Retailer

“Men don’t want to wear the clothes they wore throughout the pandemic: it’s almost like the clothes have Covid! Guys want new stuff!” Murry Penner, Penners, Houston

“With supply chain issues, we’re missing some business. Fortunately, customers seem happy to buy whatever we have.” David Perlis, Perlis, NOLA and Baton Rouge

“We’ve had triple digit increases over 2019; the driver is clearly social media!” Chuck Hellman, Hellman’s Clothiers, Cincinnati

“Our online business is minimal: I can’t compete with vendor discounts, free ship/return, GWPs, etc.” Scott Shapiro, Syd Jerome, Chicago

“Stores need to experiment with lesser-known luxury brands. They learned when they couldn’t get Brand A that Brand B might prove even better.” Marc Weiss, Management One

“Will tailored business continue this strong? Of course not! But we’re riding the wave and feeding the machine until it bottoms out!” Tom Malvino, Louis Thomas, Corte Madera and Petaluna California

“Suits, shirts and furnishings have been on fire: we couldn’t get enough white shirts!” Jay Fillings, Fillings, Lancaster, Pa

“We’re happy to have the challenges we face today vs what we were dealing with a year ago.” Rick and Jim Penn, Puritan Menswear

“We’re short staffed: I went to the mall to steal people, but couldn’t find anyone I wanted!” Ed Boas, Lanes Miami

Karen, every story you write is terrific, but this one was exceptional and bravo to all the retailers and the boom their businesses are experiencing!