GUEST EDIT: PAUSE AND REFLECT

The numbers yesterday from Zumiez and Buckle for July were good. Of course, they reflected the first big week of back-to-school that was not included for some from last year. However, these stores are better, and I expect the same type of results from both Abercrombie & Fitch and American Eagle. Another major ingredient is that much of the competition has simply gone away: Claire’s, Rue 21, Delia’s, Quiksilver, Aeropostale (mostly), The Limited, Wet Seal, and American Apparel. The survivors should do better.

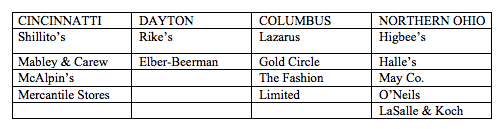

Putting together this number of closures or dramatic reduction has caused me to pause and reflect on my career in the industry in total. Perhaps it all means I have been around too long. A non-industry friend recently asked me how the business had changed over the years. I thought about Ohio. When I began in the business, the dream job was a road salesman in Ohio. In the 250-mile stretch between Cincinnati and Cleveland there were so many stores to sell, some small, some huge.

The change in our industry has been dramatic. We were and still are dramatically overstored. The last few years have shown 5.000+ yearly door closings. Some come from liquidations and some from the culling of the store fleets. But for the most part, while the nameplates went away, the doors remained with a different name. But for that road salesman in Ohio, this is not even close to the whole story. The stores have become vertical. Major players like Gap, Old Navy, the entire teen chain businesses are all private brands. The department stores goal is to be 50 percent private label/brand. The stores are now the designers, the production, the marketing and the distribution experts. Plus, while the doors might still exist in each geographic area, the sole decision makers are elsewhere. Elsewhere is increasingly not in New York and with the exception of Columbus, certainly not in Ohio. Fewer stores, fewer vendors, fewer buying executives and fewer vendor executives. The internet is an altogether another ingredient. Clearly it is now the biggest ingredient.

All of the above has led to an unfortunate lack of newness in the market. But all is not lost. The cost of entry into the apparel business remains low. Creative people remain drawn to the apparel business. It was not so long ago that now successful, meaningful startups took the risks: Vineyard Vines, Under Armour, Robert Graham, Southern Tide, etc.

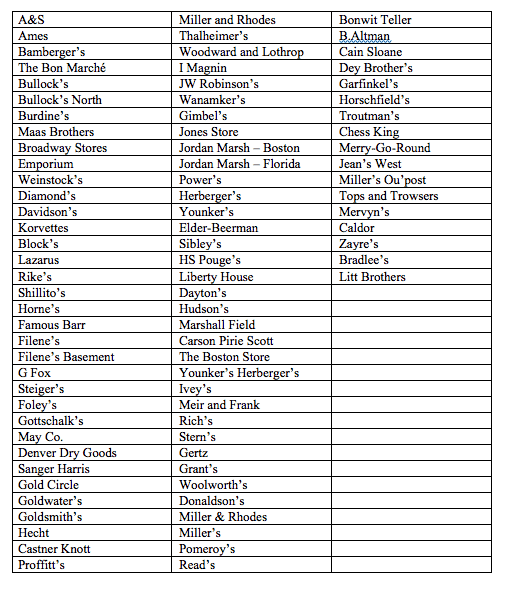

I thought it would be fun to reflect on the missing, most of whom I used to sell:

—

Fred Rosenfeld is an industry consultant. He can be reached at frosenfeld@comcast.net.