CREATING THE EXPERIENCE

Experiential retail is a ubiquitous phrase inspiring both promise and panic. But fear not: Successful experiential retail is no different from what exceptional retail has always been. The roots of both, and the future of retail overall lie in giving the customer something more.

According to market research company NPD Group, experiential retail refers to a store where “stuff happens in addition to selling, and shoppers do things besides buying.” Customers benefit on some level—be it entertaining, enlightening, soothing, nourishing, beautifying or educating—in a memorable way.

Brands and retailers already in experiential retail have executed in DNA-specific ways. Experiential elements can be natural extensions of the merchandise. For example, outdoor retailer REI makes available rock-climbing walls for customers to test gear as well as in-house and in-the-field kayaking, hiking, and rock-climbing courses. Athletic apparel retailer Lululemon offers in-store yoga classes. DSW now provides nail bar services, and the mattress retailer Casper hosts “sleep-before-you-buy” sessions.

Other retailers springboard from their core values, fundamentally re-imagining retail at the same time. Nordstrom Local, a wholly different service-centered concept that carries no merchandise, was introduced as a one-off in Los Angeles two years ago. Envisioned as a “neighborhood hub,” the uncharacteristically small footprint store centers around buy-online-pick-up-in-store (BOPIS), personal styling and tailoring services alongside manicure-pedicure stations and espresso, wine and juice options. The success of the concept spawned two more L.A. locations with two New York City ones in the works.

“Showrooming” is another level of experiential retail blending product and service, online and in-store. Bonobos, an innovator of the approach, moved from online into local brick-and-mortar showrooms called Bonobos Guideshops. They carry every garment available in each size, color, fit or fabric. Customers try on their selections with the help of a personal guide, who then places the order for delivery to the buyer’s home. Target has set up an interactive showroom experience in its San Francisco location called Open House. Here the retailer sells only smart home devices in a space that also offers learning and interaction with product creators.

According to U.S. census data for the first quarter of 2019, 90 percent of consumers, as comfortable as they are with online, still shop in traditional stores. Retailers like Nordstrom, DSW, and others are taking advantage, maximizing customer preferences and the path to purchase at the same time easing the pain of returns while remaining channel-agnostic. All along the customer journey, they cater to shoppers’ interests and enrich their interaction.

Men’s: A Ripe Opportunity

First Insight came out with an eye-opening report, “The Rise of the New Male Power Shopper,” earlier this year. The report indicated that on almost every front—online and traditional retail channels, in the mass market, off-price, new specialty brand, discount and luxury sectors—men’s shopping frequency surpassed women. Moreover, men are using technology for purchasing and researching prices more than women, the study found.

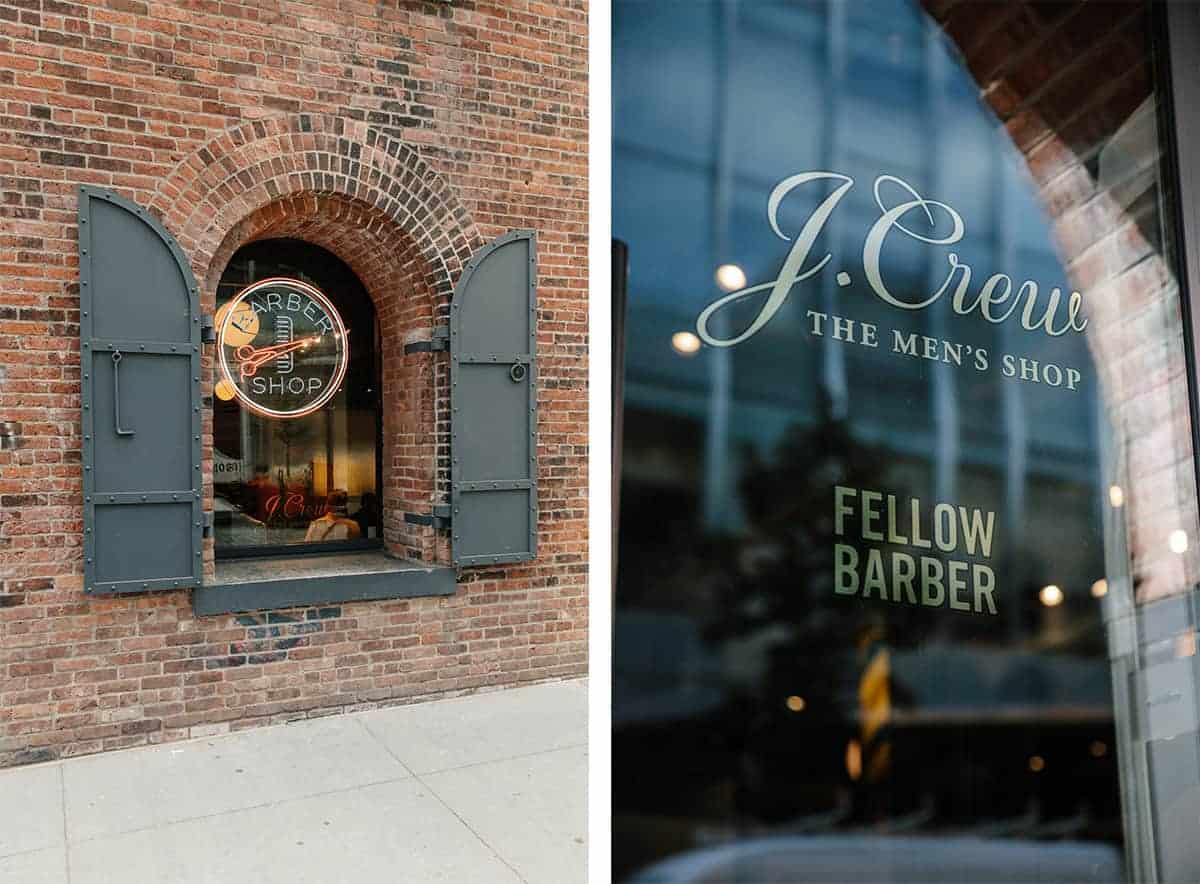

Men’s brands already staked in experiential retail reflect some of the trends found in First Insight’s report. Several have established a kind of future-past, old-world-meets-new technology strategy. Alton Lane showrooms, for example, employ 3-D body scanners for taking measurements while their customers can sip bourbon or have a spot of tea. Tommy Hilfiger’s London flagship outfits fitting rooms with touchscreen smart mirrors allowing shoppers to navigate styles and sizes which sales associates then bring them. Nordstrom opened its first-ever men’s store, located in New York City, with a liquor license and a life-size screen to digitally present the shopper his suit in exact specifications before he orders. New York City is home to many retailers offering haircuts as well as shopping—J. Crew, Barneys Downtown, Saks Fifth Avenue among them.

What Defines Experience?

How a retailer presents the experience varies by store. If a retailer has the funds and inclination to build skateboard parks in store, like Vans for example, or add music events, it should be because customer insights indicate this as a traffic driver or else because it fosters community. Classes and educational programs such as styling labs can also build community, credibility, and authenticity around brands, and showcase the all-important human interaction so unique to in-store. Plugging into customer culture, cares and concerns, including societal ones like diversity and inclusivity, is vital today to a retailer’s success.

Customer appeal can come from a single special event. In 2018, the National Retail Federation (NRF) found that 60 percent of millennial men had a great interest in retail experiences and events. Among all shoppers surveyed for its 2018/2019 Winter Consumer View report, the NRF found that 82 percent attended a retailer event in the 12 months prior, while 58 percent expressed interest in going to a retailer event in the future. What events were of most interest? The report noted 87 percent were for early/exclusive access to items or a sale, 81 percent for a party, 80 percent for a product demonstration or tutorial, 71 percent for a game or competition. The NRF concluded 69 percent of men were interested in interacting with an expert or a brand ambassador; the same percentage was attracted by pop-up shops.

A good way to provide customers with a personalized experience and retailers with information is by first learning what customers want. Gathering consumer insights via data collection, customer surveys, social media monitoring, sales data or the old-fashioned way—good communication between knowledgeable sales staff and customers—will go a long way.

Experience is Everything

Physical stores remain crucial players. KPMG’s Global Retail Trends 2019 found the top reason consumers prefer to shop in-store is to see, feel and experience the product in person. According to Google, 61 percent of consumers prefer shopping with brands that have a physical location rather than ones with an online presence only, and 80 percent went in-store when they wanted or needed something immediately. KPMG identified millennials to be twice as likely as other groups to want instant gratification, opting to go in-store to get their merchandise instead of buying online and waiting for delivery.

Additionally, today’s customer expects more individual services to be part of their retail experiences. The top three the NRF found: quality customer service, free shipping and the ability to shop online. The rising popularity of BOPIS is one way to meet this expectation and close the divide between digital and physical retail.

Experiential Crossing the Digital Divide

Technology is a critical component to enhancing the customer experience. Smart mirrors are just a toe in the water of the future of augmented reality (AR), what the forecasting agency The Future Laboratory has dubbed “programmable reality,” where the product will be transformed and customized through digital attributes. In the meantime, customers currently can use virtual reality (VR) headsets to view whole collections that can’t fit in-store and AR to try on outfits in mirrors. In addition, 360-degree views and 3-D renderings enrich product images online.

Technology is also capable of providing consistency across retail platforms and streamlining the customer journey. A recent consumer survey by BRP Consulting reveals that 96 percent of consumers find that ease of checkout influences their choice of where to shop. Technology can

link across platforms, include customer information, shopping history, purchasing behavior, and even product suggestions. This advancement not only eliminates friction points but encourages a personalized experience for the customer. Tablets in the retail space facilitate mobile checkout and assist in back-of-house stock checks. Moreover, using “Endless Aisle,” tablets enable shoppers to search limitless online inventory and customize their choices. Men using smart speakers has increased 113 percent over last year. The reason: 70 percent of guys use in-store tablets to research pricing.

At the end of the day, what is experiential retail but exceptional customer service? The goal, McKinsey and Company opined in a recent article on retail practice, is “to give customers memorable—even delightful—moments as they shop.” Entertain, educate and enlighten your customers. Listen to them to deliver the value, service, and ease of shopping they desire.